CRISIS TEXT LINE, INC. AND SUBSIDIARIES

CONSOLIDATED FINANCIAL STATEMENTS

WITH SUPPLEMENTARY INFORMATION

YEARS ENDED DECEMBER 31, 2018 AND 2017

AND

INDEPENDENT AUDITORS’ REPORT

CRISIS TEXT LINE, INC. AND SUBSIDIARIES

TABLE OF CONTENTS

Page

Independent Auditors’ Report 1

Consolidated Financial Statements

Statements of Financial Position 3

Statements of Activities 4

Statements of Functional Expenses 6

Statements of Cash Flows 8

Notes to Consolidated Financial Statements 9

Consolidating Supplementary Information for 2018

Statement of Financial Position 21

Statement of Activities 22

1

INDEPENDENT AUDITORS’ REPORT

To the Board of Directors

Crisis Text Line, Inc.

We have audited the accompanying consolidated financial statements of Crisis Text Line, Inc. and

Subsidiaries (the “Organization”), which comprise the consolidated statements of financial position as

of December 31, 2018 and 2017, and the related consolidated statements of activities, functional

expenses and cash flows for the years then ended, and the related notes to the consolidated financial

statements.

Management’s Responsibility for the Consolidated Financial Statements

Management is responsible for the preparation and fair presentation of these consolidated financial

statements in accordance with accounting principles generally accepted in the United States of

America; this includes the design, implementation, and maintenance of internal control relevant to the

preparation and fair presentation of consolidated financial statements that are free from material

misstatement, whether due to fraud or error.

Auditors’ Responsibility

Our responsibility is to express an opinion on these consolidated financial statements based on our

audits. We conducted our audits in accordance with auditing standards generally accepted in the United

States of America. Those standards require that we plan and perform the audit to obtain reasonable

assurance about whether the consolidated financial statements are free from material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures

in the consolidated financial statements. The procedures selected depend on the auditor’s judgment,

including the assessment of the risks of material misstatement of the consolidated financial statements,

whether due to fraud or error. In making those risk assessments, the auditor considers internal control

relevant to the Organization’s preparation and fair presentation of the consolidated financial statements

in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of

expressing an opinion on the effectiveness of the Organization’s internal control. Accordingly, we

express no such opinion. An audit also includes evaluating the appropriateness of accounting policies

used and the reasonableness of significant accounting estimates made by management, as well as

evaluating the overall presentation of the consolidated financial statements.

(Continued)

2

Opinion

In our opinion, the consolidated financial statements referred to above present fairly, in all material

respects, the financial position of Crisis Text Line, Inc. and Subsidiaries as of December 31, 2018 and

2017, and the changes in their net assets and their cash flows for the years then ended, in accordance

with accounting principles generally accepted in the United States of America.

Correction of Errors

As described in Note 12 to the consolidated financial statements, the Organization’s net assets as of

January 1, 2017 have been restated, which increased net assets, due to a correction of errors in a prior

year. Our opinion is not modified with respect to this matter.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for

our audit opinion.

Report on Supplementary Information

Our audit was conducted for the purpose of forming an opinion on the consolidated financial statements

as a whole. The accompanying consolidating supplementary information shown on pages 21 and 22 is

presented for purposes of additional analysis and is not a required part of the consolidated financial

statements. Such information is the responsibility of management and was derived from and relates

directly to the underlying accounting and other records used to prepare the consolidated financial

statements. The information has been subjected to the auditing procedures applied in the audit of the

consolidated financial statements and certain additional procedures, including comparing and

reconciling such information directly to the underlying accounting and other records used to prepare

the consolidated financial statements or to the consolidated financial statements themselves, and other

additional procedures in accordance with auditing standards generally accepted in the United States of

America. In our opinion, the consolidating supplementary information is fairly stated in all material

respects in relation to the consolidated financial statements as a whole.

July 31, 2019

CRISIS TEXT LINE, INC. AND SUBSIDIARIE

S

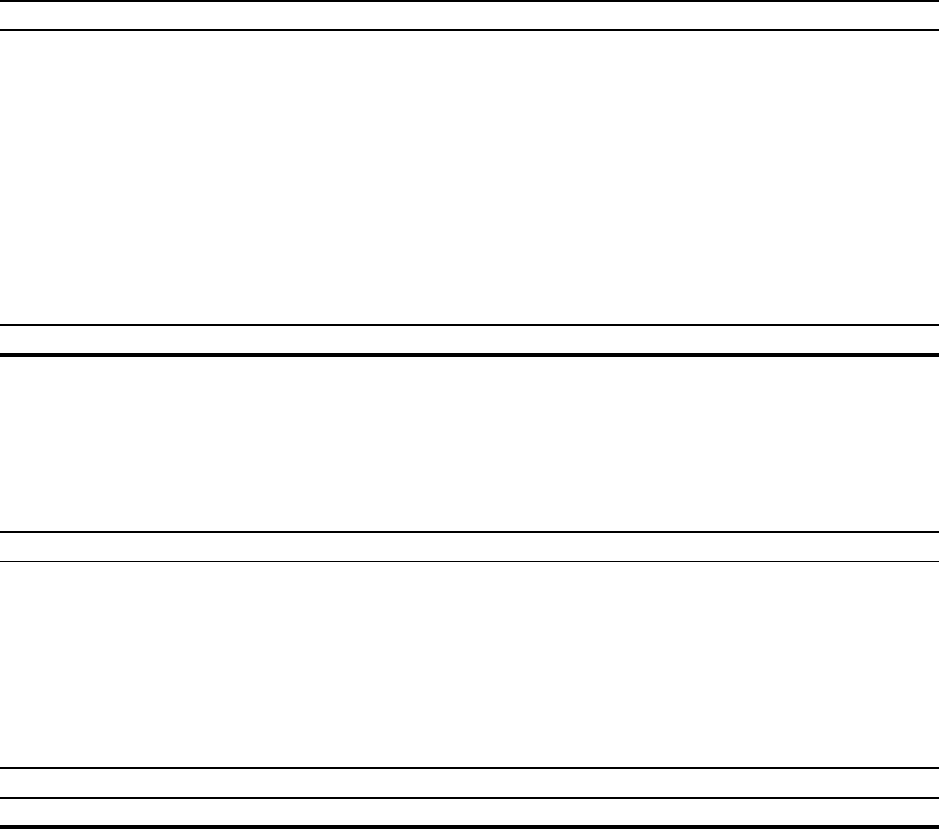

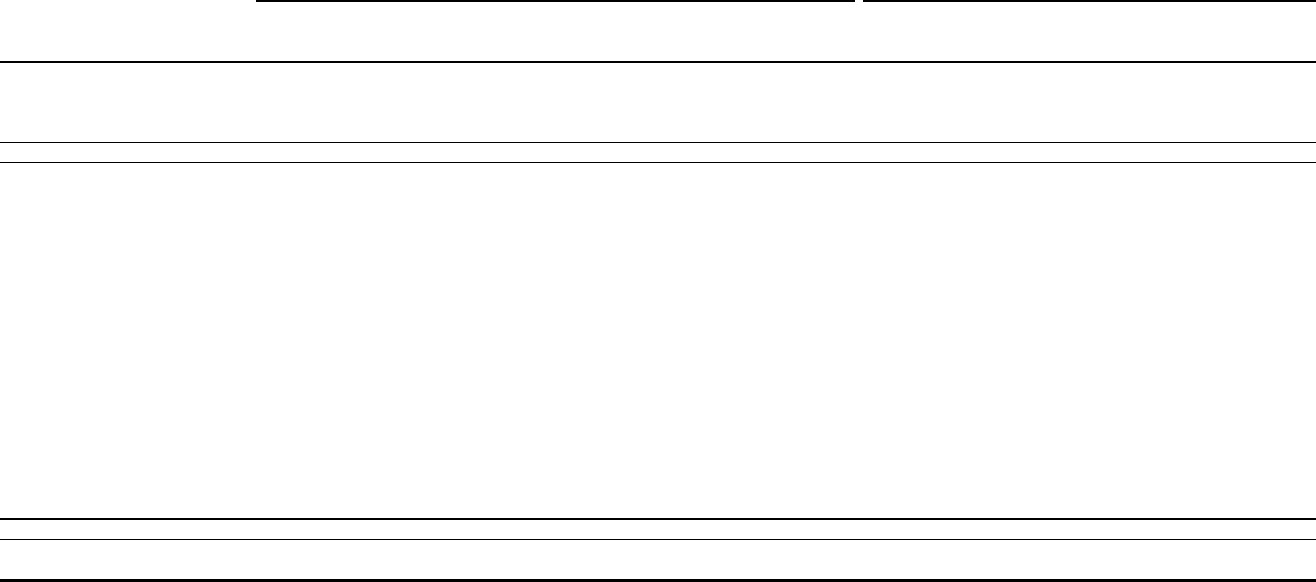

CONSOLIDATED STATEMENTS OF FINANCIAL POSITIO

N

2018 2017

ASSETS

Cash and cash equivalents 11,399,386$ 1,391,036$

Certificates of deposit 366,903 229,410

Program revenue receivable 60,537 82,366

Contributions receivable 6,194,020 6,652,200

Prepaid expenses and other assets 102,326 139,277

Investment, at fair value 19,217,411 12,671,877

Inventory 28,619 -

Property and equipment, net 26,484 5,139

Security deposits 7,584 7,584

Total assets 37,403,270$ 21,178,889$

LIABILITIES AND NET ASSETS

Liabilities

Accounts payable and accrued expenses 352,363$ 209,929$

Deferred revenue 258,789 145,833

Deferred rent 95,800 -

Total liabilities 706,952 355,762

Commitments and contingencies

Net assets

Without donor restrictions 28,894,038 13,319,265

With donor restrictions 6,816,102 7,503,862

Noncontrolling interest 986,178 -

Total net assets 36,696,318 20,823,127

Total liabilities and net assets 37,403,270$ 21,178,889$

December 31,

See notes to consolidated financial statements.

3

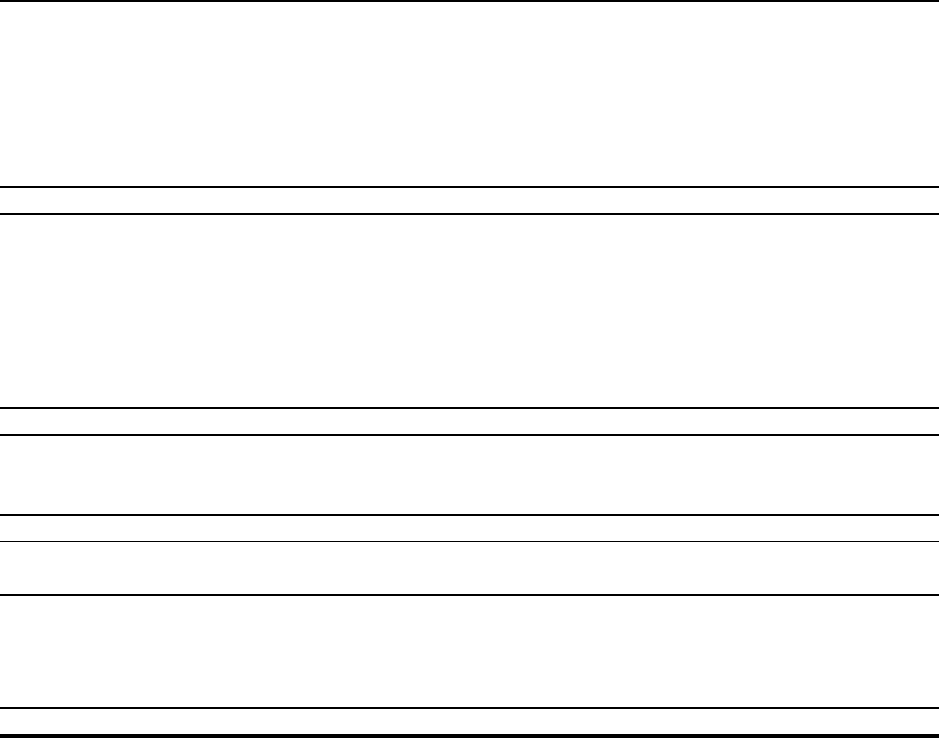

CRISIS TEXT LINE, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF ACTIVITIES

YEAR ENDED DECEMBER 31, 2018

Without Donor With Donor Noncontrolling

Restrictions Restrictions interest Total

Support and revenues

Contributions 19,262,225$ 5,774,435$ -$ 25,036,660$

Contributions in-kind 1,033,266 - - 1,033,266

Program service revenue 1,787,510 - - 1,787,510

Investment income 277,443 - - 277,443

Miscellaneous 15,026 - - 15,026

Net assets released from restrictions 6,462,195 (6,462,195) - -

Total support and revenues 28,837,665 (687,760) - 28,149,905

Expenses

Program expenses

Crisis Counselor Community 2,211,251 - - 2,211,251

Supervision 3,519,073 - - 3,519,073

Engineering and Tech 3,086,213 - - 3,086,213

Data 761,211 - - 761,211

International Expansion 943,852 - - 943,852

Total program expenses 10,521,600 - - 10,521,600

Supporting services

Management and general 2,490,312 - - 2,490,312

Fundraising 250,980 - - 250,980

Total supporting services 2,741,292 - - 2,741,292

Total expenses 13,262,892 - - 13,262,892

Loris.ai

Operating costs - - (1,013,829) (1,013,829)

Change in net assets 15,574,773

(687,760) (1,013,829) 13,873,184

Issuance of common and preferred stock - - 2,000,007 2,000,007

Net assets, beginning of year

13,319,265 7,503,862 - 20,823,127

Net assets, end of year

28,894,038$ 6,816,102$ 986,178$ 36,696,318$

See notes to consolidated financial statements.

4

CRISIS TEXT LINE, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF ACTIVITIES

YEAR ENDED DECEMBER 31, 2017

Without Donor With Donor

Restrictions Restrictions Total

Support and revenues

Contributions 886,026$ 1,700,000$ 2,586,026$

Contributions in-kind 1,323,967 - 1,323,967

Program service revenue 593,554 - 593,554

Investment income 106,216 - 106,216

Miscellaneous 9,816 - 9,816

Net assets released from restrictions 9,169,963 (9,169,963) -

Total support and revenues 12,089,542 (7,469,963) 4,619,579

Expenses

Program expenses

Crisis Counselor Community 2,788,745 - 2,788,745

Supervision 2,741,306 - 2,741,306

Engineering and Tech 2,359,405 - 2,359,405

Data 482,535 - 482,535

International Expansion 202,639 - 202,639

Total program expenses 8,574,630 - 8,574,630

Supporting services

Management and general 2,172,577 - 2,172,577

Fundraising 70,795 - 70,795

Total supporting services 2,243,372 - 2,243,372

Total expenses 10,818,002 - 10,818,002

Change in net assets 1,271,540 (7,469,963) (6,198,423)

Net assets, beginning of year, as restated

12,047,725 14,973,825 27,021,550

Net assets, end of year

13,319,265$ 7,503,862$ 20,823,127$

See notes to consolidated financial statements.

5

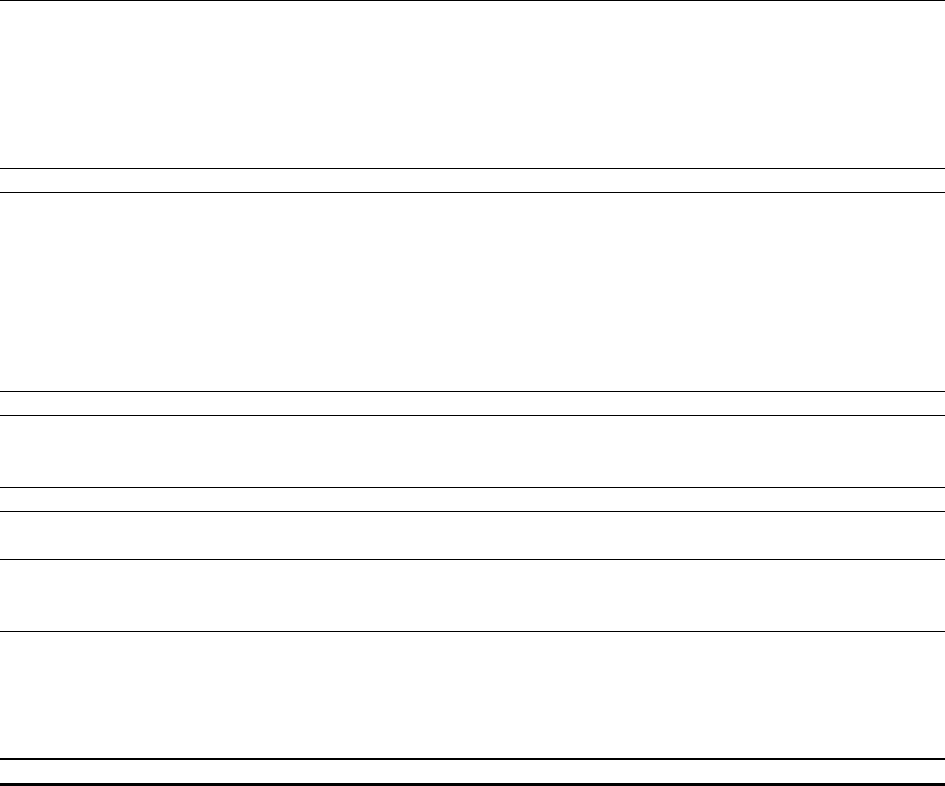

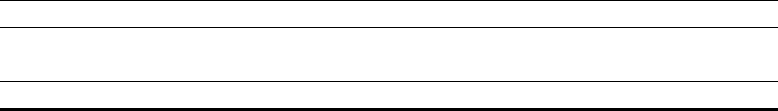

CRISIS TEXT LINE, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF FUNCTIONAL EXPENSES

YEAR ENDED DECEMBER 31, 2018

Crisis

Counselor

Community Supervision

Engineering

and Tech Data

International

Expansion

Total

Program

Management

and General Fundraising

Total

Supporting Total Expenses

Personnel costs

Salaries 1,108,811$ 2,578,035$ 1,874,715$ 436,878$ 480,688$ 6,479,127$ 671,972$ 169,986$ 841,958$ 7,321,085$

Payroll taxes and benefits 413,161

750,164 361,925 96,545 151,558 1,773,353 374,484 53,128 427,612 2,200,965

Total personnel costs 1,521,972 3,328,199 2,236,640 533,423 632,246 8,252,480 1,046,456 223,114 1,269,570 9,522,050

Other expenses

Depreciation - - - - - - 25,093 - 25,093 25,093

Equipment purchases 216 4,615 1,494 1,797 17 8,139 1,967 - 1,967 10,106

Insurance - - - - 5,434 5,434 24,123 - 24,123 29,557

In-kind advertising expenses 220,616 - - - - 220,616 - 5,075 5,075 225,691

In-kind technology expenses - - 370,606 - 29,781

400,387 - - - 400,387

In-kind legal expenses - - - - 34,875 34,875 372,313 - 372,313 407,188

Office expenses 10,343 7,330 6,249 1,333 439 25,694 39,521 12,385 51,906 77,600

Professional fees 80,306 103,554 201,218 112,444 68,554 566,076 247,338 700 248,038 814,114

Rent and utilities 13,314 6,985 2,541 - - 22,840 527,305 - 527,305 550,145

Repairs and maintenance - - 311 - - 311 23,532 - 23,532 23,843

Marketing and public relations 15,234 268 - 29,966 1,606 47,074 9,277 3,414 12,691 59,765

Subscriptions 61,767 11,066 101,789 79,391 15,301 269,314 19,958 2,314 22,272 291,586

Tech support and hosting 12,265 - 123,384 1,080 139,679 276,408 9,456 - 9,456 285,864

Travel and meetings 44,467 57,019 41,981 1,777 15,920 161,164 140,588

3,978 144,566 305,730

Volunteer expenses 230,751 37 - - - 230,788 3,385 - 3,385 234,173

Total other expenses 689,279 190,874 849,573 227,788 311,606 2,269,120 1,443,856 27,866 1,471,722 3,740,842

Total expenses 2,211,251$ 3,519,073$ 3,086,213$ 761,211$ 943,852$ 10,521,600$ 2,490,312$ 250,980$ 2,741,292$ 13,262,892$

Program Expenses

Supporting Services

See notes to consolidated financial statements.

6

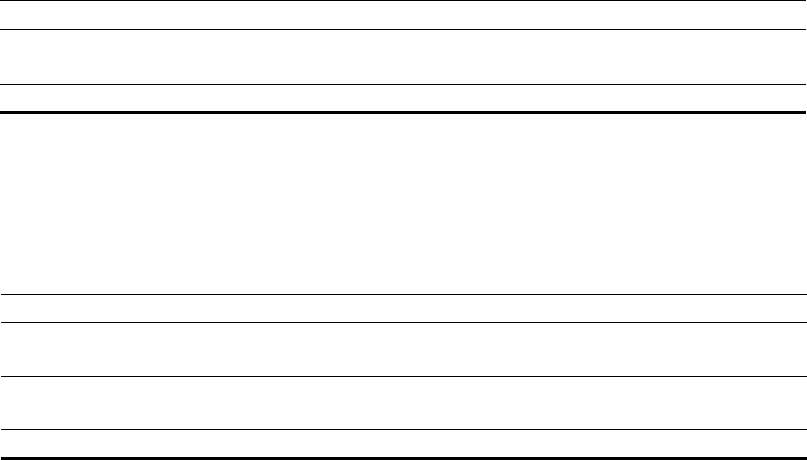

CRISIS TEXT LINE, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF FUNCTIONAL EXPENSES

YEAR ENDED DECEMBER 31, 2017

Crisis

Counselor

Community Supervision

Engineering

and Tech Data

International

Expansion Total Program

Management and

General Fundraising

Total

Supporting Total Expenses

Personnel costs

Salaries 1,401,353$ 2,017,001$ 1,305,547$ 377,677$ 89,808$ 5,191,386$ 166,356$ 59,630$ 225,986$ 5,417,372$

Payroll taxes and benefits 108,717 166,457 121,464 28,580 6,929 432,147 951,510 4,944 956,454 1,388,601

Total personnel costs 1,510,070 2,183,458 1,427,011 406,257 96,737 5,623,533 1,117,866 64,574 1,182,440 6,805,973

Other expenses

Depreciation - - - - - - 13,553 - 13,553 13,553

Equipment purchases 6,332 5,983 22,208 2,750 - 37,273 2,723 - 2,723 39,996

Insurance - - - - - - 18,016 - 18,016 18,016

In-kind advertising expenses 257,172 257,172 - - - 514,344 2,800 - 2,800 517,144

In-kind technology expenses 105,737 105,737 - - - 211,474 - -

- 211,474

In-kind legal expenses - - - - 53,440 53,440 541,909 - 541,909 595,349

Office expenses 93,493 11,250 4,332 977 4,208 114,260 23,259 4,659 27,918 142,178

Professional fees 56,063 91,225 134,859 11,200 8,273 301,620 66,530 - 66,530 368,150

Recruitment and training 28,608 3,132 16,241 454 - 48,435 1,098 87 1,185 49,620

Rent and utilities 25,848 11,229 9,447 - - 46,524 331,046 - 331,046 377,570

Repairs and maintenance - - - - - - 18,428 - 18,428 18,428

Marketing and public relations 2,668 - 1,905 453 1,897 6,923 - - - 6,923

Subscriptions 65,616 184 229,476 32,709 - 327,985 7,235 459 7,694 335,679

Tech support and hosting 13,652 800 495,759 16,093 1,114 527,418 990 - 990 528,408

Travel and meetings 82,007 70,756 18,167 11,642 36,970 219,542 25,320 1,016 26,336 245,878

Volunteer expenses 541,479 380 - - - 541,859 1,804 - 1,804 543,663

Total other expenses 1,278,675 557,848 932,394 76,278 105,902 2,951,097 1,054,711 6,221 1,060,932 4,012,029

Total expenses 2,788,745$ 2,741,306$ 2,359,405$ 482,535$ 202,639$ 8,574,630$ 2,172,577$ 70,795$ 2,243,372$ 10,818,002$

Supporting Services

Program Expenses

See notes to consolidated financial statements.

7

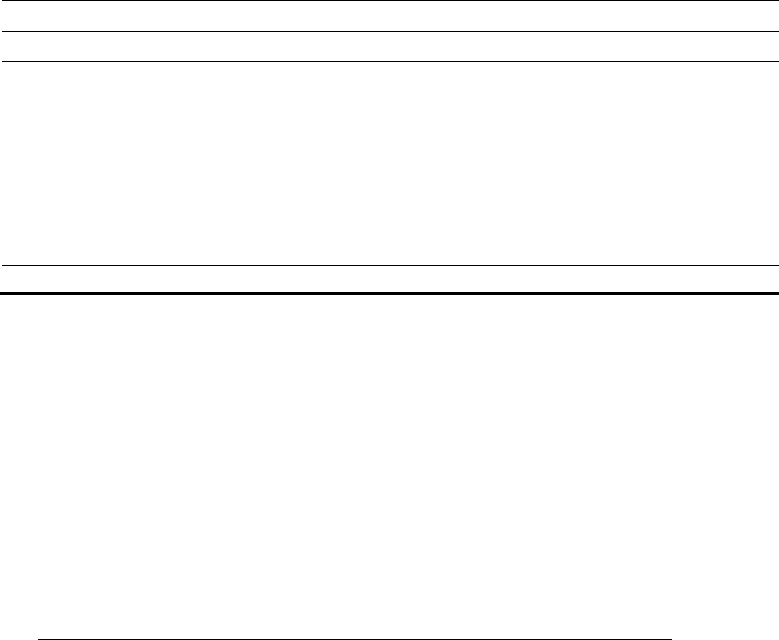

2018 2017

Cash flows from operating activities

Change in net assets 13,873,184$ (6,198,423)$

Adjustments to reconcile change in net assets to net cash provided by

operating activities

Depreciation 25,093 13,553

Net realized and unrealized (gain) losses on investments (4,378) 95,812

Changes in assets and liabilities

Program revenue receivable 21,829 51,384

Contributions receivable 458,180 7,873,765

Prepaid expenses and other assets 36,958 (4,800)

Inventory (28,619) -

Security deposits - (6,549)

Accounts payable and accrued expenses 142,434 25,004

Deferred revenue 112,956 18,748

Deferred rent 95,800 -

Net cash provided by operating activities 14,733,437 1,868,494

Cash flows from investing activities

Purchase of property and equipment (46,438) -

Certificates of deposit (137,493) (107)

Purchase of investments (11,986,288) (6,482,776)

Proceeds from sale of investments 5,445,132 2,530,000

Net cash used in investing activities (6,725,087) (3,952,883)

Cash flows from financing activities

Proceeds from issuance of preferred stock 2,000,000 -

Net increase (decrease) in cash and cash equivalents

10,008,350 (2,084,389)

Cash and cash equivalents, beginning of year 1,391,036 3,475,425

Cash and cash equivalents, end of year

11,399,386$ 1,391,036$

Noncash investing and financing activities

Common stock receivable 7$ -

Year Ended December 31,

CRISIS TEXT LINE, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

See notes to consolidated financial statements.

8

9

CRISIS TEXT LINE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1 - ORGANIZATION AND NATURE OF ACTIVITIES

Crisis Text Line, Inc. (“CTL, Inc.”), a not-for-profit organization, was incorporated in the State of

New York on April 2, 2012. CTL, Inc.’s primary purpose is to use technology and data innovations

to pioneer new approaches to support people in need. CTL, Inc.’s major program services include

the following:

Crisis Counselor Community - all costs associated with recruiting and retaining volunteers;

development and training and cultural competencies in the community to appropriately

communicate with and promote CTL, Inc. as a service to all communities.

Supervision - a dedicated group of paid supervisors that service and manage crisis counselors and

oversee all texters on the CTL, Inc. platform.

Engineering and Tech - coding, refining, and supporting the CTL, Inc. texting platform.

Data – a dedicated group of data scientists that collect and share statistical data and develop metrics

from texting activity and crisis counselor demographics.

International Expansion - all costs associated with setting up partnerships with organizations

outside of the United States to expand texting services globally.

On October 20, 2015, CTL, Inc. formed a wholly owned limited liability company organized in

New York, called Crisis Text Line International, LLC (“CTLI”). To date, there has been no activity

in CTLI. On October 18, 2018, final paperwork was submitted to the New York State Department

of State to dissolve CTLI.

Effective January 9, 2018, CTL, Inc. acquired all of the 5,300,000 authorized shares of the Class

B common stock of Loris.ai, Inc. (“Loris.ai”), a for-profit company incorporated in the state of

Delaware. Loris ai’s purpose is to leverage CTL, Inc.’s de-escalation techniques, emotional

intelligence strategies, and training experience to develop real-time training software for customer

service agents.

CTL, Inc. receives its support primarily from donations from foundations and individuals.

10

CRISIS TEXT LINE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Consolidation

The consolidated financial statements include the accounts of CTL, Inc., its wholly owned

subsidiary, CTLI, and its majority owned subsidiary, Loris.ai (collectively, the “Organization”).

All intercompany transactions and balances have been eliminated in consolidation

Basis of Presentation

The accompanying consolidated financial statements of the Organization have been prepared on

the accrual basis of accounting in accordance with accounting principles generally accepted in the

United States of America (“GAAP”).

The consolidated financial statement presentation is in accordance with Financial Accounting

Standards Board Accounting Standards Codification (“FASB ASC”) 958, “Not-for-Profit

Entities,” as amended by Accounting Standards Update (“ASU”) No. 2016-14, “Presentation of

Financial Statements of Not-for-Profit Entities”. The Organization adopted ASU 2016-14 for the

year ended December 31, 2018 and has applied the amendments retrospectively to the 2017

consolidated financial statements and related footnotes. There have been no reclassifications in the

accompanying financial statements as a result of this adoption.

Under ASC 958, as amended, the Organization is required to report information regarding its

financial position and activities according to two classes of net assets: those without donor

restrictions and those with donor restrictions. Net assets without donor restrictions are those net

assets that are not subject to donor-imposed restrictions. Net assets with donor restrictions are

subject to donor stipulations that limit the use of their contributions which either expire by the

passage of time or when used for specified purposes.

Other major changes resulting from ASU 2016-14 include (a) requiring that all nonprofits present

an analysis of expenses by function and nature in either the statement of activities, a separate

statement, or in the notes and disclose a summary of the allocation methods used to allocate costs,

(b) requiring the disclosure of quantitative and qualitative information regarding liquidity and

availability of resources, (c) presenting investment return net of external and direct internal

investment expenses, and (d) modifying other financial statement reporting requirements and

disclosures intended to increase the usefulness of nonprofit financial statements.

11

CRISIS TEXT LINE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

Noncontrolling Interests

GAAP requires that noncontrolling interests in subsidiaries be reported in the net asset section of

a company’s consolidated statements of financial position.

Use of Estimates

The preparation of consolidated financial statements in conformity with GAAP requires

management to make estimates and assumptions that affect certain reported amounts and

disclosures. Accordingly, actual results could differ from those estimates.

Cash and Cash Equivalents

Cash balances in banks are insured by the Federal Deposit Insurance Corporation subject to certain

limitations. For consolidated financial statement purposes, the Organization considers all highly

liquid investments with an initial maturity of three months or less to be cash equivalents.

Contributions Receivable

Contributions receivable are unconditional promises to give that are recognized as contributions

when the promise is received. Contributions receivable are recorded at net realizable value if

expected to be collected in one year and, if material, multiyear receivables are recorded at the

present value of their estimated future cash flow. If applicable, amortization of the discount is

included in contribution revenue. The allowance for uncollectible contributions receivable is

determined based on management’s evaluation of the collectability of individual promises. There

were no significant contributions that management deemed to be uncollectible as of December 31,

2018 and 2017.

Investments

Investments are carried at fair value. Fair value is the price that would be received to sell an asset

in an orderly transaction between market participants at the measurement date. Realized and

unrealized gains and losses are reflected in the consolidated statement of activities. To satisfy its

long-term rate-of-return objectives, the Organization relies on a total return strategy in which

investment returns are achieved through both capital appreciation (realized and unrealized) and

current yield (interest and dividends). The Organization purchases fixed income securities and

Treasury bonds to achieve its long-term and short-term return objectives, while maintaining

portfolio stability and preserving capital. Donated securities are recorded at their fair market value

on the date received.

12

CRISIS TEXT LINE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

Fair Value

GAAP establishes a framework for measuring fair value. That framework provides a fair value

hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The

hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets

or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3

measurements). Under GAAP, the three levels of the fair value hierarchy are described as follows:

Level 1: Inputs to the valuation methodology are unadjusted quoted prices for identical assets

or liabilities in active markets that the Organization has the ability to access.

Level 2: Inputs to the valuation methodology include:

Quoted prices for similar assets or liabilities in active markets;

Quoted prices for identical or similar assets or liabilities in inactive markets;

Inputs other than quoted prices that are observable for the asset or liability; and

Inputs that are derived principally from or corroborated by observable market data by

correlation or other means.

If the asset or liability has a specified (contractual) term, the Level 2 input must be observable

for substantially the full term of the asset or liability.

Level 3: Unobservable inputs that reflect management’s own assumptions.

Property and Equipment

Office furniture, equipment and software are carried at cost if purchased, or if acquired in-kind, at

their fair market value at the date of the gift. Any expenditure over $1,000 in these categories is

capitalized. Fixed assets are depreciated using the straight-line basis over the estimated useful lives

of the assets.

13

CRISIS TEXT LINE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

Program Service Fees

The Organization provides 24/7 crisis counselor services to various communities through

partnership agreements. In addition, it provides a premium data dashboard that updates daily and

offers the ability to filter, aggregate, and analyze statistical data. Program service fees paid in

advance totaled $198,789 and $145,833 at December 31, 2018 and 2017, respectively. Program

service fees are recognized at the time such services are performed.

Contribution Revenue

Contributions, including unconditional promises to give, are recognized when received. All

contributions are reported as increases in unrestricted net assets unless use of the contributed assets

is specifically restricted by the donor.

In-Kind Contributions

Contributions of donated noncash assets are recorded at fair value in the period received.

Contributions of donated services that create or enhance nonfinancial assets, or that require

specialized skills, provided by individuals possessing those skills and typically required to be

purchased if not provided by donation, are recorded at fair value in the period received.

Functional Allocation of Expenses

The consolidated financial statements report certain categories of expenses that are attributed to

more than one supporting function. As such, some expenses require allocation that properly reflects

shared costs at a reasonable basis that is consistently applied. The Organization, uses a direct

allocation of personnel costs that include eligible employee benefits, taxes and salaries, etc. based

upon the time spent on functional areas. Specific expenses related to technology, professional fees,

and travel are directly charged to the function they are related. Administrative costs including

general liability and business operations are directly charged as management overhead.

14

CRISIS TEXT LINE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

Accounting for Income Taxes

CTL, Inc. is exempt from income taxes under Section 501(c)(3) of the Internal Revenue Code.

Accordingly, no provision for federal, state or local income taxes has been recorded.

Loris.ai accounts for deferred taxes using the asset and liability method as specified by ASC 740,

“Income Taxes”. Deferred income tax assets and liabilities are determined based on differences

between the financial statement reporting and the tax basis of assets and liabilities, operating losses

and tax credit carryforwards. Deferred income taxes are measured using the enacted tax rates and

laws that are anticipated to be in effect when the differences are expected to reverse. The

measurement of deferred income tax assets is reduced, if necessary, by a valuation allowance for

any tax benefits which are not expected to be realized. The effect on deferred income tax assets

and liabilities of a change in tax rates is recognized in the period that such tax rate changes are

enacted.

Reclassifications

Certain amounts relating to the prior year have been reclassified to conform to the current year’s

presentation. The reclassifications had no effect on net assets.

Subsequent Events

These consolidated financial statements were approved by management and available for issuance

on July 31, 2019. Management has evaluated subsequent events through this date.

3 - CONTRIBUTIONS RECEIVABLE

Contributions receivable consisted of the following:

December 31,

2018 2017

Amount due in less than one year $ 5,444,020 $ 5,510,533

Amount due from one to five years 750,000 1,141,667

$ 6,194,020 $ 6,652,200

15

CRISIS TEXT LINE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

4 - INVESTMENTS

Investments at fair value consisted of fixed income securities at December 31, 2018 and 2017, all

of which are classified as Level 1, in accordance with the fair value hierarchy discussed in Note 2.

Net investment income (including interest income from the certificate of deposit) consisted of the

following:

Year Ended December 31,

2018 2017

Interest and dividends $ 273,065 $ 202,028

Net unrealized and realized gains (losses) 4,378 (95,812)

Net investment income $ 277,443 $ 106,216

5 - PROPERTY AND EQUIPMENT

Property and equipment consisted of the following:

December 31,

2018 2017

Equipment $ 71,611 $ 38,580

Furniture and fixtures 19,230 5,823

90,841 44,403

Less - Accumulated depreciation 64,357 39,264

$ 26,484 $ 5,139

Depreciation expense amounted to $25,093 and $13,553 for the years ended December 31, 2018

and 2017, respectively.

6 - CONCENTRATIONS

For the year ended December 31, 2018, three donors accounted for 68% of total support and

revenues.

16

CRISIS TEXT LINE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

7 - IN-KIND CONTRIBUTIONS

Contributions in-kind that are included in the consolidated financial statements consisted of the

following:

Year Ended December 31,

2018 2017

Type of Service Received

Value of Services

Advertising $ 225,691 $ 517,144

Technology 400,387 211,474

Legal:

Gibson, Dunn and Crutcher LLP* 318,872 541,909

Steptoe and Johnson LLP 53,441 53,440

Kestenberg Siegal Lipkus LLP 34,875 -

$ 1,033,266 $ 1,323,967

*A Board member of CTL, Inc. is a partner with this law firm.

8 - COMMITMENTS AND CONTINGENCIES

Leases

The Organization leases 11,000 sq. ft. of office space under a noncancelable operating lease set to

expire on September 30 2026. As of December 31, 2018, the minimum aggregate annual rental

commitments are approximately as follows:

Year Ending

December 31,

2019 $ 660,357

2020 678,517

2021 697,176

2022 716,348

2023 739,063

Thereafter 2,970,692

17

CRISIS TEXT LINE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

8 - COMMITMENTS AND CONTINGENCIES (Continued)

Leases (Continued)

In lieu of a security deposit for the office lease, the Organization was required to provide the

landlord with a standby letter of credit issued. As part of the amended lease agreement for the 7

th

floor office space, the landlord required an increase in the amount of $137,500 for a total of

$366,667. The letter of credit is currently in the process of renewal with the Bank of America.

Total rent expense was $525,168 and $331,694 for the years ended December 31, 2018 and 2017,

respectively.

Litigation

The Organization was a plaintiff (and defendant by counterclaim) in a lawsuit in Canada, involving

a trademark dispute. On June 12, 2019, the parties signed a confidential conditional settlement

agreement resolving the matter. The settlement is immaterial in relation to the consolidated

financial statements taken as a whole.

9 - RETIREMENT PLAN

The Organization established a defined contribution pension plan covering substantially all of its

employees. Pension expenses under this plan were $174,690 and $132,263 for the years ended

December 31, 2018 and 2017, respectively.

10 - NET ASSETS WITH DONOR RESTRICTIONS

The following summarizes the changes in temporarily restricted net assets:

Released Balance,

Balance, from December 31,

Program January 1, 2018, Contributions Restrictions 2018

Data $ - $ 699,435 $ - $ 699,435

International expansion 100,000 - (50,000) 50,000

Time restriction 6,750,000 5,000,000 (5,858,333) 5,891,667

Other 653,862 75,000 (553,862) 175,000

Total $ 7,503,862 $ 5,774,435 $ (6,462,195) $ 6,816,102

18

CRISIS TEXT LINE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

10 - NET ASSETS WITH DONOR RESTRICTIONS (Continued)

Balance, Released Balance,

January 1, 2017, from December 31,

Program as Restated Contributions Restrictions 2017

Data $ 536,480 $ - $ (536,480) $ -

International expansion - 100,000 - 100,000

Time restriction 13,783,483 1,600,000 (8,633,483) 6,750,000

Other 653,862 - - 653,862

Total $ 14,973,825 $ 1,700,000 $ (9,169,963) $ 7,503,862

11 - LIQUIDITY AND AVAILABILITY OF FINANCIAL ASSETS

The Organization’s financial assets due within one year of the date of these financial statements

that are available for general expenditures, including grant funded activities, are as follows:

Cash and cash equivalents $ 11,399,386

Certificates of deposit 366,903

Program revenue receivable 60,537

Contributions receivable 6,194,020

Investments, at fair value 19,217,411

Total financial assets as of December 31, 2018 $ 37,238,257

Less - amounts due in one to five years 750,000

Total financial assets available within one year $ 36,488,257

The Organization’s goal is to maintain liquidity to meet operational and strategic needs. Ongoing

liquidity needs of the Organization are monitored to ensure that minimum cash flow requirements

are met. A liquidity account is also established within the investment portfolio that is not less than

three months of working capital. This amount was approximately $3.6 million for the year ended

December 31, 2018 to assure same-day availability of money necessary to fund daily operations on

a planned or as-needed basis.

19

CRISIS TEXT LINE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

12 - CORRECTION OF ERRORS

In reviewing its net assets at January 1, 2017, the Organization realized that incorrect accounting

treatment was applied to the recognition of contribution revenue. Management had previously

determined that a number of contributions were conditional due to reporting requirements

associated with them and, accordingly, did not recognize the full amount of contribution revenue.

Upon further review, management determined that the possibility that such conditions will not be

met are remote, and the full amount of contribution revenue should have been recognized.

Accordingly, the Organization’s net assets at January 1, 2017 have been restated and increased as

follows:

Temporarily

Unrestricted Restricted Total

Net assets at January 1, 2017, as

previously reported

$ 10,028,855

$ 2,072,912

$ 12,101,767

Adjustments:

To recognize contributions previously

deemed conditional

-

13,925,965

13,925,965

To adjust deferred revenue for

unconditional contributions

595,956

397,862

993,818

To adjust classification of net assets 1,422,914 (1,422,914) -

Net assets, January 1, 2017, as restated $ 12,047,725 $ 14,973,825 $ 27,021,550

13 - LORIS.AI

Common and Preferred Stock

Upon inception in 2018, Loris.ai authorized and issued various shares. Total authorized Class A

voting shares are 4,700,000 with a par value of $0.00001 per share, of which 700,000 are issued to

the CEO of CTL, Inc. and outstanding at December 31, 2018. Total authorized Class B voting

shares are 5,300,000 with a par value of $0.00001 per share, of which 5,300,000 are issued to CTL,

Inc. and outstanding at December 31, 2018. Total authorized Preferred shares are 2,500,000 with

a par value of $0.00001 per share, of which 2,500,000 are issued and outstanding at December 31,

2018. Total capital of $2,000,000 was raised by the Preferred shareholders during the year ended

December 31, 2018.

20

CRISIS TEXT LINE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

13 - LORIS.AI (Continued)

Deferred Tax Asset

Deferred tax assets have been provided for deductible temporary differences related to net

operating losses. Management has determined that these deferred tax assets have no net realizable

value until realization is assured. Management believes this net realizable value at December 31,

2018 is deemed appropriate due to the uncertainty of future taxable income of Loris.ai.

Due to the United States tax legislation enacted in December 2017, the corporate tax rate was

reduced to 21% from 35%. This revised tax rate was used by management in calculating the net

deferred tax assets and the effect on the deferred tax balances for the federal and state taxes

applicable to Loris.ai.

At December 31, 2018, Loris.ai had a net operating loss carryforward of approximately

$1 million which may be utilized to offset any future taxable income through 2038.

Subsequent Events

In February 2019, Loris.ai’s Board of Directors approved the 2018 Incentive Compensation Plan

(the "2018 Plan") enabling Loris.ai to grant stock-based awards to employees, directors and

consultants. The 2018 Plan provides for the awards of incentive stock options, stock appreciation

rights, dividend equivalent rights, restricted stock, restricted stock units and other stock-based

awards. Awards generally vest equally over a period of four years from the grant date. Vesting is

accelerated under a change in control of Loris.ai or in the event of death or disability to the

recipient. In the event of termination, any unvested shares or options are forfeited. Loris.ai has

reserved and made available 1,500,000 shares of common stock for issuance under the 2018 Plan.

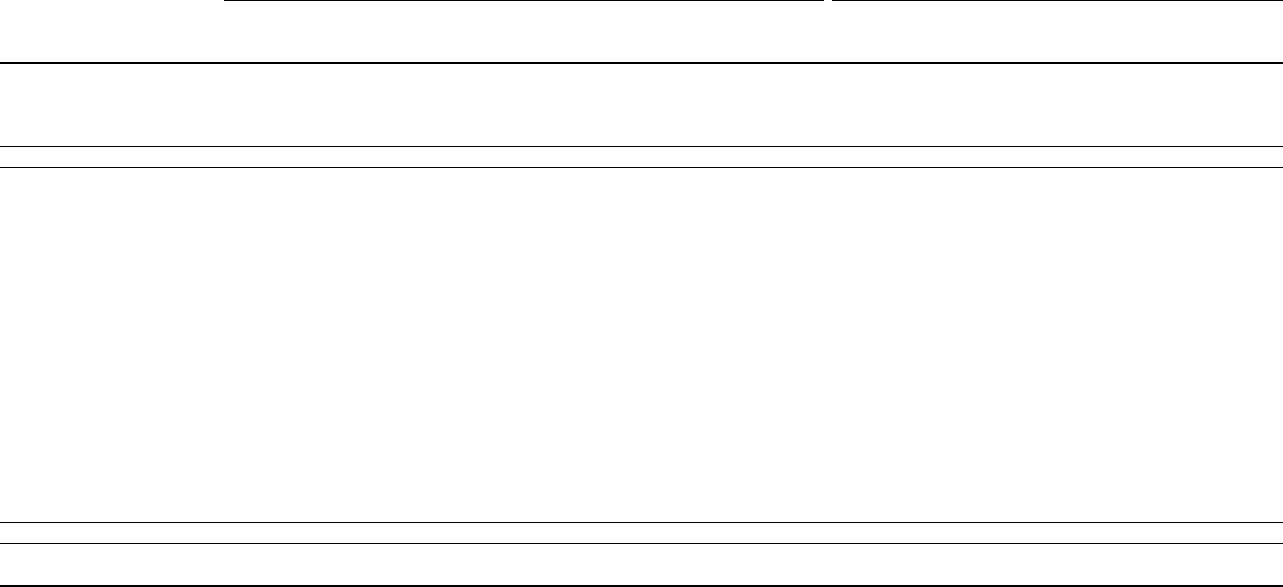

CONSOLIDATING SUPPLEMENTARY INFORMATION

Crisis Text Crisis Text Line Adjustments/

Line, Inc. Loris.ai, Inc. International, LLC Eliminations Consolidated

ASSETS

Cash and cash equivalents

$ 10,375,420 $ 1,023,966 $ - $ - $ 11,399,386

Certificates of deposit

366,903 - - - 366,903

Program revenue receivable 60,537

- - - 60,537

Contributions receivable

6,203,763 - - (9,743) 6,194,020

Prepaid expenses and other assets

91,533 10,846 - (53) 102,326

Investment, at fair value

19,217,411 - - - 19,217,411

Investment in Loris.ai, Inc.

53 - - (53) -

Inventory

28,619 - - - 28,619

Property and equipment, net

26,484 - - - 26,484

Security deposits

7,584 - - - 7,584

Total assets

36,378,307$ 1,034,812$ -0-$ (9,849)$ 37,403,270$

LIABILITIES AND NET ASSETS

Liabilities

Accounts payable and accrued expenses

$ 348,535 $ 13,624 $ - $ (9,796) $ 352,363

Deferred revenue

198,789 60,000 - - 258,789

Deferred rent

95,800 - - - 95,800

Total liabilities

643,124 73,624 - (9,796) 706,952

Net assets

Without donor restrictions

28,919,081 - - (25,043) 28,894,038

With donor restrictions

6,816,102 - - - 6,816,102

Noncontrolling interest

- 961,188 - 24,990 986,178

Total net assets

35,735,183 961,188 - (53) 36,696,318

Total liabilities and net assets

36,378,307$ 1,034,812$ -0-$ (9,849)$ 37,403,270$

CRISIS TEXT LINE, INC. AND SUBSIDIARIES

CONSOLIDATING STATEMENT OF FINANCIAL POSITION

DECEMBER 31, 2018

See Independent Auditors' Report.

21

Crisis Text Crisis Text Line Adjustments/

Line, Inc. Loris.ai, Inc. International, LLC Eliminations Consolidated

Support and revenues

Contributions

$ 25,036,660 $ - $ - $ - $ 25,036,660

Contributions in-kind

1,033,266 - - - 1,033,266

Program service revenue 1,787,510

- - - 1,787,510

Investment income

277,443 - - - 277,443

Miscellaneous

40,069 - - (25,043) 15,026

28,174,948 - - (25,043) 28,149,905

Expenses

Program expenses

Crisis Counselor Community

2,211,251 - - - 2,211,251

Supervision

3,519,073 - - -

3,519,073

Engineering and Tech

3,086,213 - - -

3,086,213

Data

761,211 - - -

761,211

International Expansion

943,852 - - -

943,852

Total program expenses

10,521,600 - - - 10,521,600

Supporting services

Management and general

2,490,312 - - - 2,490,312

Fundraising

250,980 - - - 250,980

Total supporting services

2,741,292 - - - 2,741,292

Total expenses

13,262,892 - - - 13,262,892

Loris.ai

Operating costs

- (1,038,872) - 25,043 (1,013,829)

Change in net assets

14,912,056 (1,038,872) - - 13,873,184

Issuance of common and preferred stock

- 2,000,060 - (53)

2,000,007

Net assets, beginning of year

20,823,127 - - -

20,823,127

Net assets, end of year

35,735,183$ 961,188$ -0-$ (53)$ 36,696,318$

CRISIS TEXT LINE, INC. AND SUBSIDIARIES

CONSOLIDATING STATEMENT OF ACTIVITIES

YEAR ENDED DECEMBER 31, 2018

See Independent Auditors' Report.

22