1

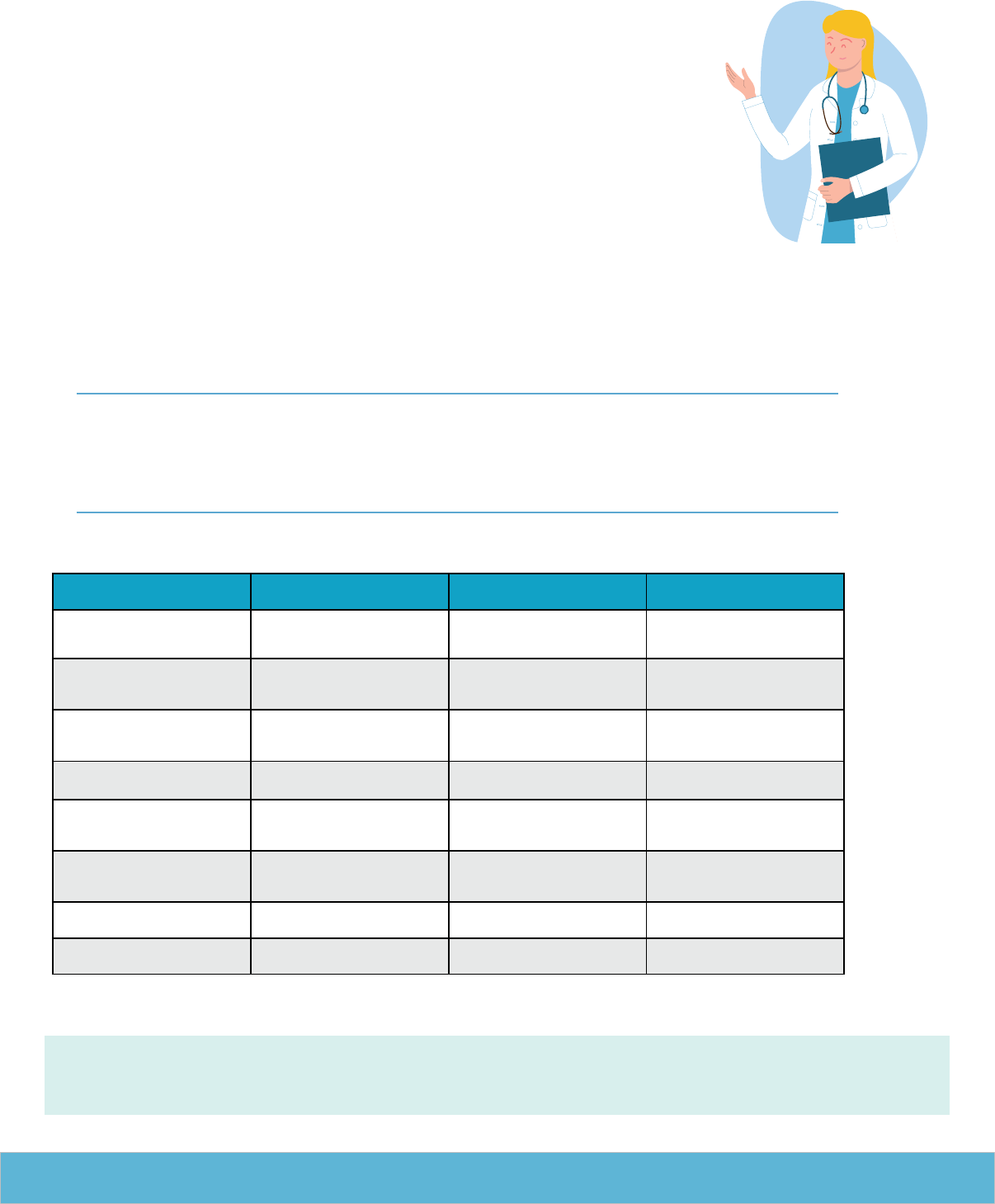

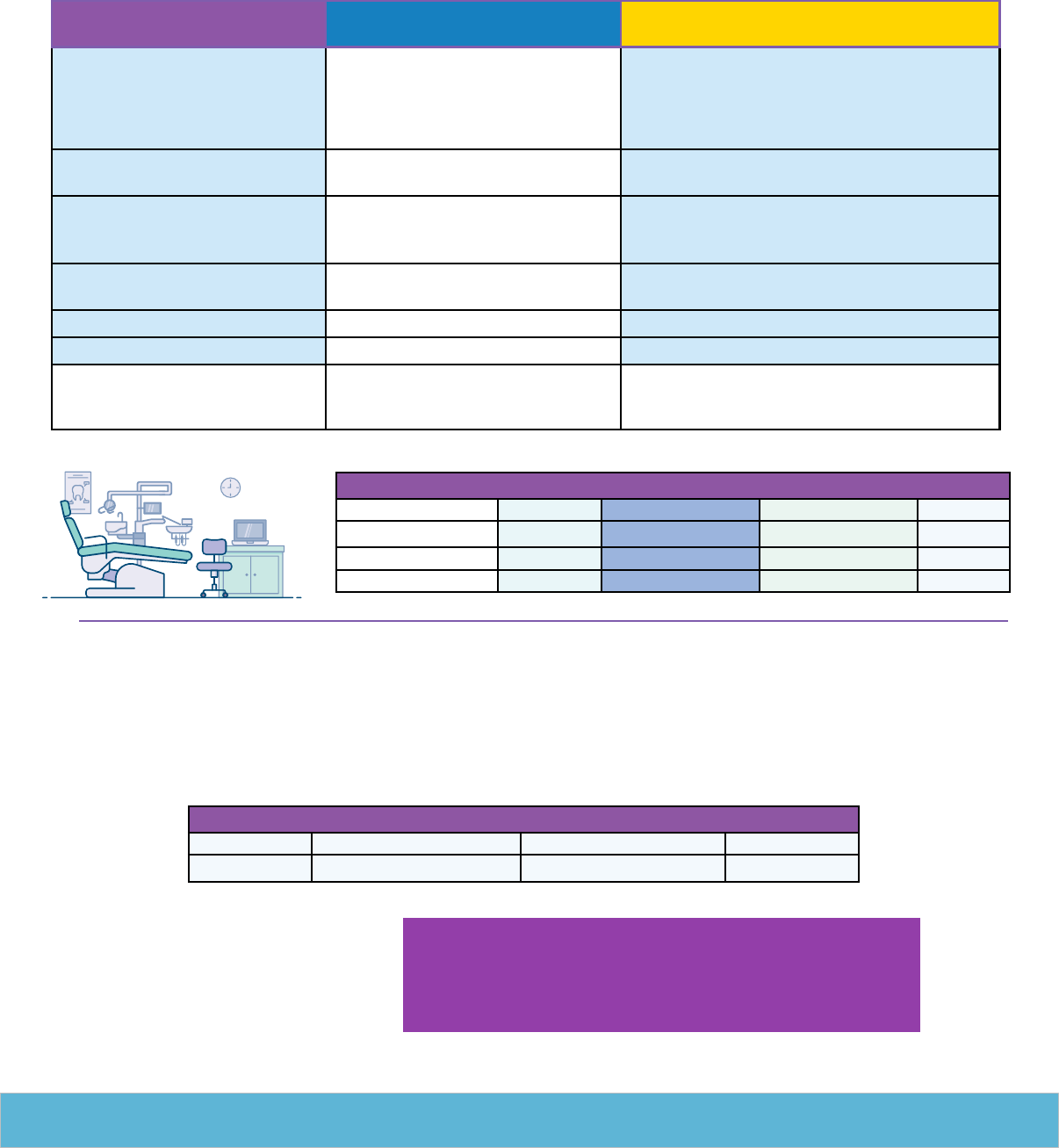

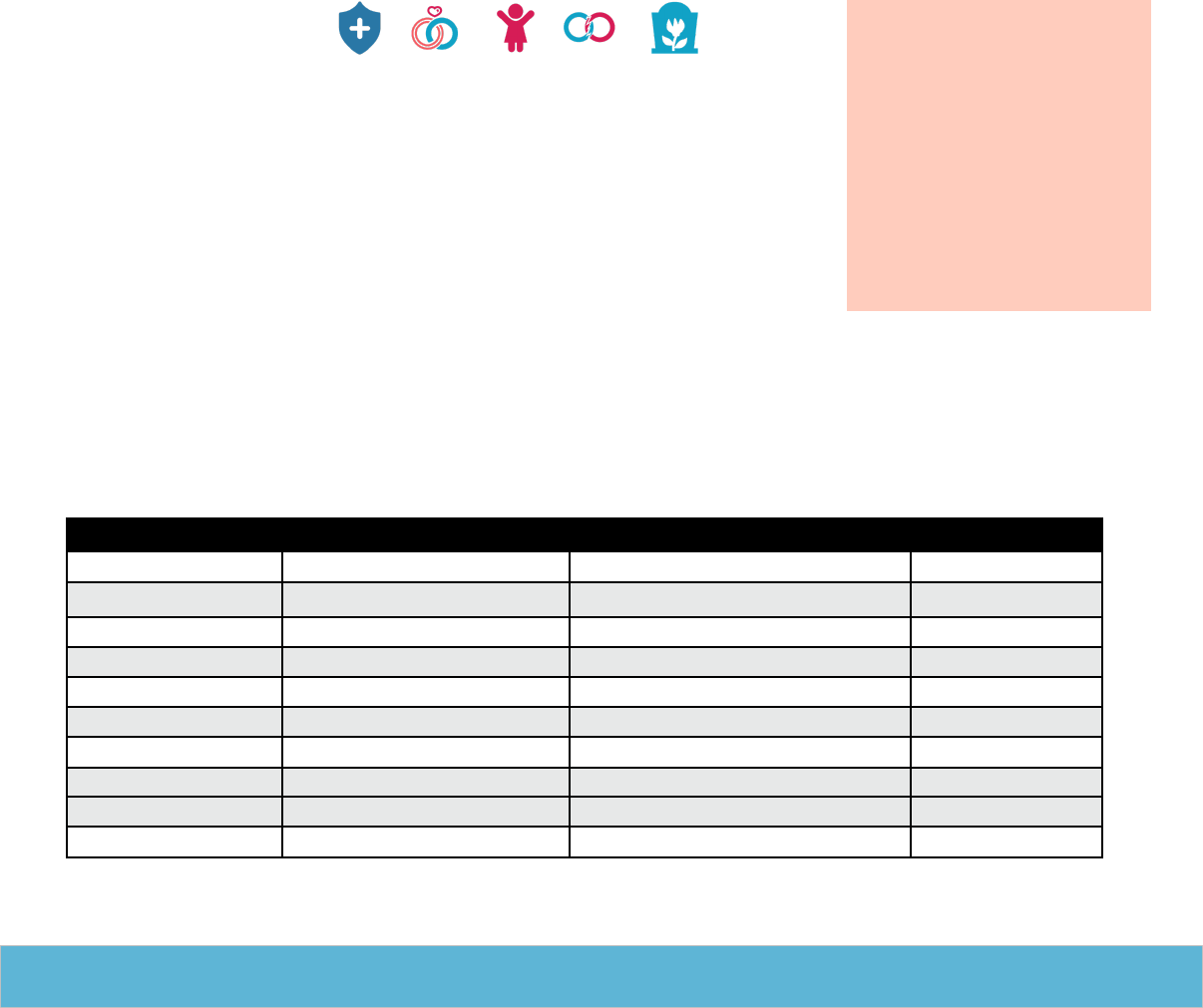

Benet Takes Eect Enrollment Cost-Share

Health, dental and vision Your hire date Auto-enrolled in Aetna Plus

after 30 days if you take no

action

VUMC shares the cost of the

health plan; You pay the full

cost of dental and/or vision

403(b) Retirement Plan

You can contribute right away.

Employer match eligibility

varies.*

Auto-enrolled after one year VUMC shares the cost

Life insurance Your hire date Auto-enrolled in basic life

insurance

VUMC pays the cost of

basic; You pay the full cost of

supplemental life insurance

Long-term disability First of the month after 30 days

of employment*/eligibility

Auto-enrolled after 30 days VUMC shares the cost

Accidental Death &

Dismemberment

(optional)

Your hire date Self-enrollment You pay the full cost

Short-term disability Enhanced coverage begins the

rst of the month following 30

days of employment/eligibility

Auto-enrolled in enhanced

coverage after 30 days

VUMC shares the cost

Flexible Spending

Accounts

First of the month following 30

days of employment/eligibility

Self-enrollment You pay the full cost

Tuition assistance 3 months from your hire date* Self-enrollment VUMC pays the full cost

2024 Benefits Overview

As a Vanderbilt University Medical Center employee, you make a difference to our

patients and their families by bringing compassion and care to those in need of hope

and healing. VUMC extends this culture of caring to you and your family by providing a

comprehensive and flexible benefits package to help you lead longer and healthier lives.

Read this overview carefully and choose the best benefits for you and your family.

Benefits at a Glance (example for new full-time regular staff)

About this booklet

This document provides information about your benefit options. It is not meant to replace the summary plan descriptions

(SPDs), which are the governing documents for VUMC benefits. SPDs are available at hr.vumc.org/ benefits/sbc-eoc.

Offerings and plans are subject to change. Prices are valid for the 2024 plan year.

How to find Benefits help

There are two ways to get answers to your Benefits questions:

• Visit the Workday Help Center to find answers to frequently asked questions in the self-

help articles, or you can click on Create Case to get help from a HR Specialist. You can find a link to Workday

on the HR website homepage at hr.vumc.org. Workday Help is a quick way to get answers to your HR-related

questions. It also gives you one place to track, communicate about, and view more information about the case.

• Should you still need additional assistance regarding how to enroll in your benefits, you can call the Employee

Service Center at 615.343.7000.

*Examples shown are for regular, full-time staff. Some programs’ guidelines and eligibility vary for faculty, house staff and post-docs. Refer to

your faculty manual for guidance.

Salary and ABBR

Benefits are tied to your Annual Base Benefits Rate, or ABBR. For most employees, your ABBR is equal to your annual salary.

2

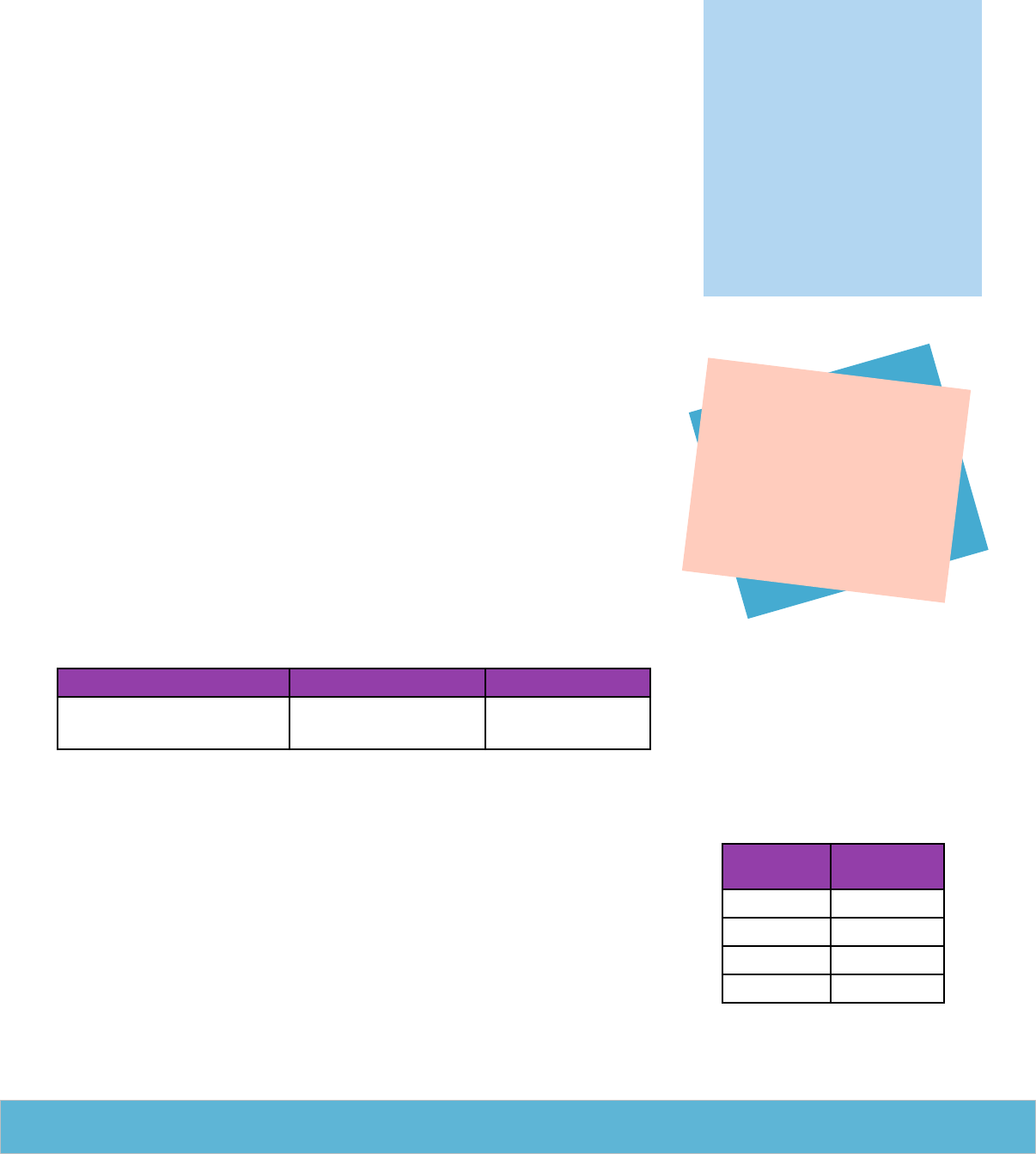

Who is eligible?

Vanderbilt University Medical Center is pleased to offer a comprehensive and flexible

benefits package. Use the information below and this chart to determine who is eligible

for each type of benefit.

Fully benefits-eligible employees

If you work at least 30 hours a week and are a regular, full-time staff or faculty member,

then you are eligible for most benefits beginning on your hire date.

Partially benefits-eligible employees

Partially benefits-eligible employees and their dependent children are eligible for VUMC health plan coverage. If you

are a monthly paid employee not already eligible for benefits, or a weekly or biweekly paid employee who is regularly

scheduled to work 20 to 29 hours per week, then you are partially benefits-eligible. TempForce (temporary), adjunct,

and flex are also partially benefits-eligible if they meet the previous requirements.

Fully benefits-eligible employees

Partially benefits-eligible employees

Health Plan

Prescription plan

Dental plan

Vision plan

AD&D

Retirement plan

Short-term disability

Long-term disability

Life insurance

Pet insurance

flexPTO

Go for the Gold

MTA discounts

Auto/home insurance

FSAs

Health Plan

Prescription plan

Retirement plan

Pet insurance

flexPTO (except Tempforce)

Go for the Gold

MTA discounts

Auto/home insurance

3

VUMC Health Plan

Health Plan Options

VUMC offers three health plan options:

All three are strong, high-quality

options and provide similar services and

networks. The differences come in the

cost-sharing amounts — meaning the

premiums, deductibles, copayments and

out-of-pocket maximums.

VUMC pays a significant part of the

health expenses you and your family

members may incur. You will be

automatically enrolled in the Aetna Plus

employee-only option and charged if

you are fully benefits eligible, unless you

make changes or opt-out within 30 days

of your hire date.

Preventive Care

All plan options provide 100 percent

coverage for preventive care and

screenings, with no deductible or copay

required, as long as the service meets the

guidelines for a preventive care service,

is not for screening of a diagnosis, and is

done at a Tier 1 or 2 provider.

Please refer to the Evidence of Coverage

for the health plan option of your

choice for more information regarding

preventive care benefits. Information

can be found on the Human Resources

website, hr.vumc.org, under Benefits.

ID Cards

You will receive two ID cards if you enroll

in any health plan option, one from

Aetna for medical and one from Navitus

for prescription drugs. If you need a

duplicate card, contact the appropriate

vendor to make the request.

Please remember that

you choose a health

plan option when you

enroll, not a network.

Evidence of Coverage

Booklets

For full details of each health plan

option, see each option’s Evidence

of Coverage booklet at hr.vumc.

org/benefits/sbc-eoc.

Summary of Benefits and

Coverage

VUMC provides a Summary of

Benefits and Coverage for each

health plan option. Required by law,

the SBCs provide an easy-to-un-

derstand summary about each

health plan’s benefits and cover-

age. You can find them at

hr.vumc.

org/benefits/sbc-eoc.

Provider Directories

Visit hr.vumc.org/benefits/medical for a link to the Aetna directory.

Aetna Plus

Aetna Select

Health Savers with Health Savings

Account (HSA)

4

Using the Tier 1: VUMC/VHAN Affiliates

This sheet helps you choose a health plan option based on the providers (doctors, facilities, other health professionals) that

you use. For full details of each health plan option, see each option’s Evidence of Coverage booklet at hr.vumc.org/benefits.

The Aetna Health Savers Plan comes with an HSA account. If you elect employee-only coverage, VUMC deposits $750 into the HSA

account in equal amounts throughout the year. If you elect spouse or family coverage, VUMC deposits $1,500 into the HSA account

in equal amounts throughout the year.. You can use these funds to meet your deductible. Certain out-of-network services require prior

authorization or else the out-of-pocket limit does not apply.

*Labs, tests, and imaging subject to deductable and coinsurance.

Aetna Plus

Health Plan Option

Aetna Select

Health Plan Option

Health Savers Plan

Health Plan Option

Annual deductible

Individual: $750

Family maximum: $1,400

Individual: $700

Family maximum: $1,400

Employee only: $1,800

Employee plus:

Individual: $3,200,

Family: $3,500

Coinsurance

20% after deductible 10% after deductible 10% after deductible

Out-of-pocket limit

Individual: $4,000

Family maximum: $7,500

Individual: $3,500

Family maximum: $7,000

Individual: $6,500

Family maximum: $12,500

Preventive visit

$0 $0 $0

Telehealth and eVisits

$5 copay $5 copay

10% after deductible10% after deductible

Sick visit,

specialist visit,

mental health visit

$25 copay $25 copay 10% after deductible

Urgent care visit*

$50 copay $50 copay 10% after deductible

Emergency room visit*

$125 copay $125 copay 10% after deductible

Hospital inpatient,

outpatient,

diagnostic testing

20% after deductible 10% after deductible 10% after deductible

Skilled nursing,

home health,

hospice, therapy

20% after deductible 10% after deductible 10% after deductible

5

Using the Tier 2: Aetna Preferred Network

This sheet helps you choose a health plan option based on the providers (doctors, facilities, other health professionals) that

you use. For full details of each health plan option, see each option’s Evidence of Coverage booklet at hr.vumc.org/benefits.

Aetna Plus

Health Plan Option

Aetna Select

Health Plan Option

Health Savers Plan

Health Plan Option

Annual deductible

Individual: $2,650

Family maximum: $5,300

Individual: $2,200

Family maximum: $4,400

Employee only: $3,000

Employee plus:

Individual: $3,200,

Family: $6,000

Coinsurance

60% after deductible 60% after deductible 60% after deductible

Out-of-pocket limit

Individual: $6,000

Family maximum: $10,000

Individual: $6,000

Family maximum: $10,000

Individual: $6,500

Family maximum: $12,500

Preventive visit

$0 $0 $0

Telehealth and eVisits

$60 copay$60 copay $60 copay$60 copay 60% after deductible60% after deductible

Sick visit,

specialist visit,

mental health visit

$60 copay $60 copay 60% after deductible

Urgent care visit*

$75 copay $75 copay 60% after deductible

Emergency room visit*

$125 copay $125 copay 60% after deductible

Hospital inpatient,

outpatient,

diagnostic testing

60% after deductible 60% after deductible 60% after deductible

Skilled nursing,

home health,

hospice, therapy

60% after deductible 60% after deductible 60% after deductible

The Aetna Health Savers Plan comes with an HSA account. If you elect employee-only coverage, VUMC deposits $750 into the HSA

account in equal amounts throughout the year. If you elect spouse or family coverage, VUMC deposits $1,500 into the HSA account

in equal amounts throughout the year.. You can use these funds to meet your deductible. Certain out-of-network services require prior

authorization or else the out-of-pocket limit does not apply.

*Labs, tests, and imaging subject to deductable and coinsurance.

6

Using Tier 3: Out of Network

This sheet helps you choose a health plan option based on the providers (doctors, facilities, other health professionals) that

you use. For full details of each health plan option, see each option’s Evidence of Coverage booklet at hr.vumc.org/benefits.

Aetna Plus

Health Plan Option

Aetna Select

Health Plan Option

Health Savers Plan

Health Plan Option

Annual deductible

Individual: $5,000

Family maximum: $10,000

Employee only: $5,000

Employee plus:

Individual: $5,000,

Family: $10,000

Employee only: $5,000

Employee plus:

Individual: $5,000,

Family: $10,000

Coinsurance

70% after deductible 70% after deductible 70% after deductible

Out-of-pocket limit

Individual: $8,500

Family maximum: $16,500

Individual: $8,500

Family maximum: $16,500

Individual: $11,000

Family maximum: $21,500

Preventive visit

70% after deductible 70% after deductible 70% after deductible

Telehealth

70% after deductible 70% after deductible 70% after deductible

Sick visit,

specialist visit,

mental health visit

70% after deductible 70% after deductible 70% after deductible

Urgent care visit*

70% after deductible 70% after deductible 70% after deductible

Emergency room visit*

$125 copay $125 copay 10% after deductible

Hospital inpatient,

outpatient,

diagnostic testing

70% after deductible 70% after deductible 70% after deductible

Skilled nursing,

home health,

hospice, therapy

70% after deductible 70% after deductible 70% after deductible

The Aetna Health Savers Plan comes with an HSA account. If you elect employee-only coverage, VUMC deposits $750 into the HSA

account in equal amounts throughout the year. If you elect spouse or family coverage, VUMC deposits $1,500 into the HSA account

in equal amounts throughout the year.. You can use these funds to meet your deductible. Certain out-of-network services require prior

authorization or else the out-of-pocket limit does not apply.

*Labs, tests, and imaging subject to deductable and coinsurance.

7

VUMC employees and their dependents enrolled in VUMC health care plans are eligible to participate in the MyHealth

Bundles program. The program “bundles” all the services you need to succeed with both common and complex health

conditions and provides personalized, concierge-level services through a patient navigator, streamlined care and lower or no

out-of-pocket costs.

To learn more, visit https://www.vanderbilthealth.com/program/myhealth-bundles.

Bundles

Current bundles include:

MyMaternityHealth

For pre- and post-natal care

MyHearingHealth

For cochlear implant surgery

MyHeartHealth

For Cardiac Arrhythmia treatment

MySpineHealth

For select spinal surgeries

MyOncologyHealth

Personalized support for individuals diagnosed

with cancer

MyOrthoHealth

For hip and knee replacement

MyOrthoHealth

For osteoarthritis of the hip and knee

MyOrthoHealth

For orthopedic care for shoulder pain

MyWeightLossHealth

For surgical weight loss

MyWeightLossHealth

For medical weight loss

MyUrologyHealth

For kidney stone treatment

MyRecoveryHealth

For substance use disorder support

For Health Savers Plan Members

VUMC’s Health Savers plan members and their dependents are eligible to participate in the MyHealth Bundles

program. Annual deductible minimums required through the Health Savers plan will still apply. For details about

how your Health Savers benefits work with the MyHealth Bundles program, schedule a time to speak with a

Bundles Navigator at VUMC.myvanderbilthealthbenefits.com or by calling 615.936.BNDL (2635).

Visit vumc.myvanderbilthealthbenefits.com for more information and to connect to a patient navigator.

8

Prescription Drug Benefit

Navitus Health Solutions administers the prescription drug benefit for VUMC employees enrolled in one of the

three health plan options. The prescription drug benefit is a multi-level formulary (i.e, list of covered drugs) with a

recommended generic program. For members of the Aetna Plus and Aetna Select plans, the prescription drug benefit

includes a copay for Level 1 drugs and coinsurance for Level 2, 3 and specialty drugs. If you select the Health Savers Plan,

you will be required to pay the full amount of your prescription drug costs until you meet your deductible.

The VUMC Health Plan encourages employees to use the VUMC pharmacies, where you will get the best price for

prescriptions. You can also take advantage of the Vanderbilt Mail Order Pharmacy, meaning your medications will

be shipped for free. Visit vumc.org/rx-outpatient/employee-home-delivery-service to learn more.

There is a calendar year prescription coinsurance and copay limit of $2,500 for individuals or $5,000 for families

for Plus and Select members. Not all prescription drugs are covered by the VUMC Health Plan. Some prescription

drugs require prior authorization from Navitus Health Solutions before the prescription can be filled. If you fill a

prescription at an out-of-network pharmacy, you won’t receive the prescription benefit. Visit navitus.com for more

information.

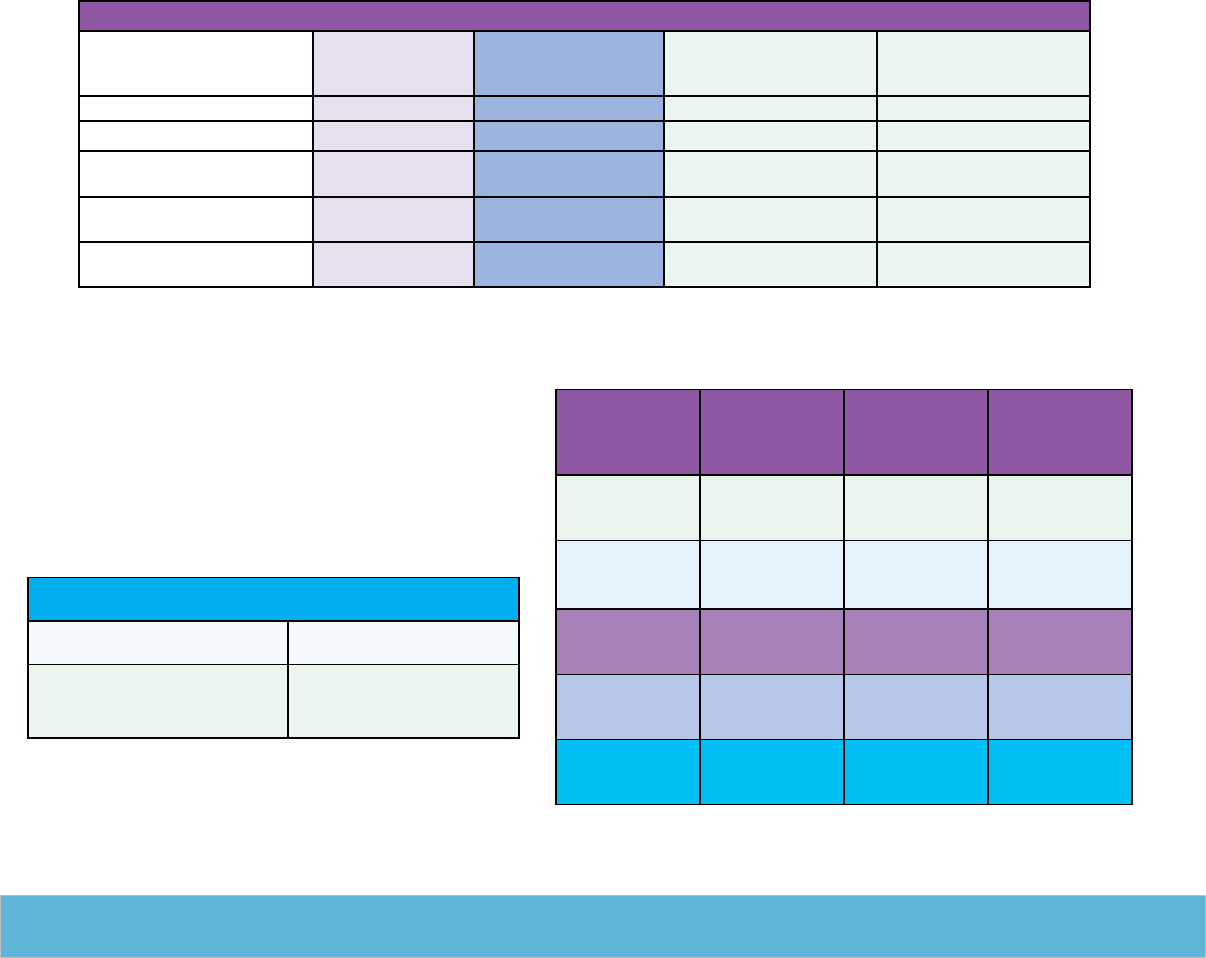

2024 Pharmacy Plan Design (Select & Plus)

30-day fills VUMC Phamarcy Walgreens Pharmacy Retail Network

Pharmacy

Vanderbilt

Mail Order/Pick Up

Maintenance generic drugs $1 copay $12 copay $15 copay $3 copay

Level 1 $5 copay $12 copay $15 copay $15 copay

Level 2 30% coinsurance

w/$75 max

30% coinsurance

w/$100 max

50% coinsurance

w/$125 max

30% coinsurance

w/$150 max

Level 3 50% coinsurance

w/$100 max

50% coinsurance

w/$125 max

70% coinsurance

w/$150 max

50% coinsurance

w/$250 max

Specialty 10% coinsurance

w/$125 max

Not available Not available Not available

Health Savers Plan Pharmacy Deductible

Deductible (Employee Only) Employee Only: $1,800

Deductible (Employee +)

Individual: $3,200

Family: $3,500

Drug Level

VUMC Pharmacy

Walgreens

Pharmacy

All other non-

preferred

pharmacies

Maintenance

generic drugs

30% after

deductible (max

$5)

N /A N /A

Tier 1

30% after

deductible (max

$5)

35% after

deductible (max

$12)

70% after

deductible (max

$20)

Tier 2

50% after

deductible (max

$75)

55% after

deductible (max

$100)

70% after

deductible

(max$125)

Tier 3

70% after

deductible (max

$100)

75% after

deductible (max

$125)

90% after

deductible (max

$150)

Specialty

10% after

deductible (max

$125)

N /A N /A

In the Health Savers Plan, the employee is

responsible for the full cost of prescriptions until

the deductible is met.

2024 Pharmacy Plan Design

(Health Savers Plan)

9

VanderbiltRX

Vanderbilt pharmacies offer convenience with a the VanderbiltRx app, which allows

you to:

• Place refill orders for pickup

• Set up reminders to refill prescriptions

• Set up reminders to take your medicine

• Transfer a prescription with a snap of a photo (mobile only)

The app works at these Vanderbilt pharmacies:

• The Vanderbilt Clinic

• Medical Center East

• Monroe Carell Jr. Children’s Hospital at Vanderbilt

• Vanderbilt Health One Hundred Oaks

How to get started:

You need a prescription with a participating Vanderbilt Pharmacy and must be enrolled in the My Health at

Vanderbilt app. MHAV will confirm your identity and auto populate your prescription information in the new app.

Employees without the MHAV app can sign up online at Vanderbilt Health. Should you have an issue signing up,

call the Help Desk at 615-343-HELP/3-4357.

The app is available for VUMC Health Plan employees and their dependents. Specialty, Transplant and Home

Delivery prescriptions are not eligible to manage within this new app at this time.

The app is accessible via the web and on mobile. Visit www.VanderbiltRx.com to use the tool or for instructions

on how to download the app to your mobile device. You can also access the pharmacy app using the MHAV app.

Click on the Menu icon and scroll down to Vanderbilt RX Pharmacy to connect to the app.

One of the pharmacy team members can help you with questions about your medication(s), refills or shipments.

Call the pharmacy at 615.875.4999.

10

Your member ID is 86 plus your

VUMC employee ID. You can find your

employee ID in Workday.

!

Cigna Dental Care (DHMO) BlueCross BlueShield DentalBlue

(PPO)

Delta Dental (PPO)

No deductibles, waiting periods

or dollar maximum. Orthodonic

coverage is for both adults and

children.

$50 deductible and 12-month waiting

period for orthodontia. The deductible

does not apply to basic cleaning and

x-rays. Orthodontic coverage is for

children only.

$50 deductible and 12-month waiting period for

orthodontia. The deductible does not apply to basic

cleaning and x-rays. Orthodontic coverage is for

children only.

There is a copay (set fee) for dental

services.

There is no copay; there is coinsurance. There is no copay; there is coinsurance.

Smaller network of dentists and

must choose a primary dentist

Larger network of dentists Offers the largest provider network in the nation

through the Delta Dental PPO and Premier

networks.

Does not provide out-of-network

coverage

Offers out-of-network coverage Offers out-of-network coverage

Referrals needed for specialists No referrals needed No referrals needed

No annual benefit maximum Benefit maximum is $1,500 a year Benefit maximum is $1,500 a year

Some procedures have frequency

limits, such as one cleaning per

6-month period.

Some procedures have frequency limits,

such as one cleaning per 6-month

period.

Some procedures have frequency limits, such as

one cleaning per 6-month period.

Dental plan: monthly payroll premiums

Dental Plan Option Employee Employee + Spouse Employee + Children Family

Cigna DHMO $18.61 $31.63 $38.51 $47.82

BCBS PPO $31.15 $61.86 $74.67 $104.89

Delta Dental PPO $27.90 $55.47 $69.90 $104.75

Vision plan

Vision plan services run on a rolling cycle, based on date of service instead of a calendar year. MetLife offers a wide network

of providers, including Vanderbilt Eye Institute, Target, Wal-Mart and Lens Crafters. Your coverage includes eye examinations,

prescription eyewear and contact lenses through a provider network that includes both ophthalmologists and optometrists.

MetLife: monthly payroll premiums

Individual Individual + Spouse Individual + Children Family

$6.53 $10.93 $11.46 $18.64

Dental plan

VUMC offers three dental plans: Cigna Dental Care (DHMO), BlueCross BlueShield Dental (PPO), and Delta Dental (PPO). The

dental plan is a benefit paid for by employees and runs on a rolling cycle, based on date of service, instead of a calendar year.

11

Flexible spending accounts (FSA) let you pay for many of your out-of-pocket medical or day care expenses with tax-free

dollars. You decide how much of your pretax wages you want taken out of your paycheck and put into an FSA. You don’t

have to pay taxes on this money. If you are enrolled in the Health Savers plan, you are not eligible to enroll in an FSA.

This is because the Health Savers Plan comes with a health savings account (HSA), which you can use to pay for the

same medical expenses. The chart below shows the differences between an HSA and FSA.

Note that your flexible spending account selection will not carry over to 2024. If you want to participate in an

FSA for 2024, you will need to enroll on My VUMC

Benefits.

Healthcare FSA

This FSA reimburses you for eligible health care

expenses, such as copays, coinsurance, dental,

prescriptions, and eyeglasses. See a complete

list of eligible expenses by visiting irs.gov/

publications/p502.

The minimum you can contribute is $104 per

year; the maximum you can contribute in 2024

is $3,050. If both you and your spouse work, you

can both contribute $3,050.

Dependent Day Care FSA

This FSA allows you to set aside money to pay

for day care expenses for children under the age

of 13 or elder care. The day care must be used as

a means to allow you and/or your spouse to be

employed.

The minimum you can contribute is $104 per

year; the maximum you can contribute is $5,000

per year. If both you and your spouse work, you

need to coordinate with your spouse so that your

total household contribution does not exceed

$5,000.

Note about Flexible Spending Accounts

You have until March 15, 2025 to incur an expense and April 15, 2025 to file a claim on your 2024 FSA. At the end of the

grace period, though, you will lose any money left over in your FSA. So, it’s important to plan carefully and not put more

money in your FSA than you think you’ll spend within a year.

No catch up

Use it or

lose it

Cannot invest

Employer

oers an FSA

Funds available at the

beginning of the year for

health FSA or as deposited

for dependent care FSA

Can only make

contribution changes at

Open Enrollment or for

a qualifying life event

Max contribution for employee:

Health FSA: $3,050

Dependent care FSA: $5,000

$1,000 catch up for

age 55 or older

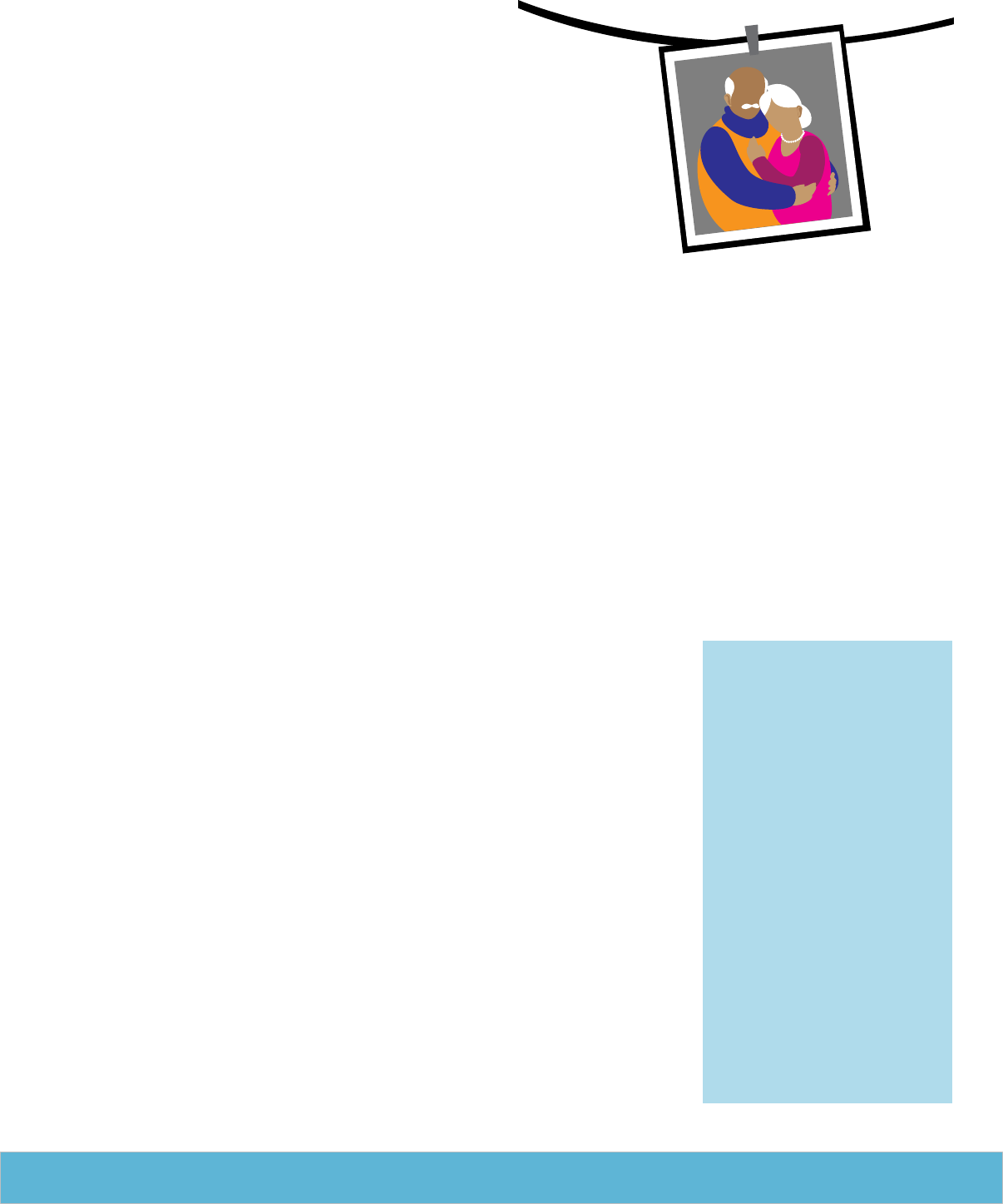

Health Savings Account Flexible Spending Account

Accumulates

year over year

Investment

opportunities

Must be enrolled in

a High Deductible

Health Plan

Funds available

as they are

deposited

Make changes to

contributions

throughout the year

2024 HSA Limits

Individual: $4,150

Family: $8,300

HSA

vs

FSA

Flexible Spending Accounts

12

403(b) Retirement Plan

The Vanderbilt University Medical Center

403(b) Retirement Plan is a mandatory

long-term investment program for

eligible faculty and staff to prepare for

retirement. Fidelity Investments is the

administrative services provider.

Eligibility

• Full-Time Staff and House Staff:

The retirement plan is optional when

you are new, but becomes mandatory

at your one-year anniversary. You are

automatically enrolled at the mandatory

level, but can participate at the voluntary

level during your first year. (If you are

covered by a collective bargaining unit,

other plan terms may apply.)

• Part-Time Staff: The retirement

plan will also become mandatory

once you have completed one year of

service and 1,000 hours within a twelve

month period. You can participate

at the voluntary level prior to being

automatically enrolled at the mandatory

level.

• Faculty*: Your enrollment generally

begins on the first of the month following

your appointment date.

Contribution Levels

• Mandatory: 3 percent (6.47 percent

for VMG faculty) of your annual salary.

VUMC matches 3 percent dollar-for-

dollar.

• Voluntary: any contribution above

the mandatory level. VUMC matches 2

percent of your voluntary contributions

dollar-for-dollar as long as you contribute

at least 2 percent.

Mandatory contributions will be in

addition to any voluntary contributions

you elect. Voluntary contributions cannot

exceed IRS limits. Each year the IRS

determines the annual maximum you can

save toward retirement. To view current

IRS limits, visit the HR website (hr.vumc.

org/benefits/retirement/limits).

Returning Employees

If you are a returning employee in an

eligible position, and were eligible for the

retirement match during your previous

VUMC employment, you are required to

participate and will be eligible to receive

matching contributions generally on the

first of the month immediately following

your re-employment date.

* For faculty, VMG and executive

administration members: Those

whose compensation exceeds

$130,000 by Dec. 31 of their first

year working at VUMC meet the

highly compensated employee

threshold established under IRS

guideline 414(q)(1)(B). If you meet

this threshold, VUMC’s matching

contributions will stop until you

have completed one year of

service.

You will be eligible for matching

contributions again on the first of

the month following the one-year

anniversary of your appointment/

hire date. This is a requirement

of the plan to meet non-

discrimination regulations. See the

Faculty Manual for more details.

Get guidance to help plan for your

future by meeting one-on-one or

over the phone with a Fidelity Dedi-

cated Retirement Planner.

Visit www.netbenefits.com/VUMC

or call 800.642.7131 to schedule

an appointment. Dedicated retire-

ment planners can help you learn

about investment funds, discuss

how much money you may need

at retirement, review your current

investments, learn how to initiate

a rollover, or discuss investment

strategies.

How to Enroll

To manage your retirement account, visit Fidelity NetBenefits at

netbenefits. com/VUMC to register your account, enroll in the plan, designate your

beneficiaries and select your investments.

The website offers online tools to help you with your retirement planning and

decision making.

If you don’t enroll before your eligibility begins, you will be automatically enrolled in

Fidelity’s Vanguard Target Date Fund.

13

Life Insurance

VUMC provides Basic Life Insurance in an amount equal to your Annual Base Benefits

Rate (typically your annual salary) up to $500,000. Life Insurance is administered by

MetLife. Your life insurance begins on your hire date.

You can change your supplemental life election at any time, but adding coverage

after your initial enrollment period will require a MetLife Statement of Health Form,

underwriting review, and you may be denied coverage.

You can add supplemental life coverage of up to 8 times your annual base benefits rate —

up to a maximum of $1,000,000. If you elect supplemental life coverage within your new

employee enrollment period, there is no medical review required for coverage that does

not exceed $500,000 or 3 times your annual salary. If you are past your new employee

enrollment period and want to increase your coverage by an additional salary multiple, or

are a new employee and are requesting over $500,000 or 3 times your annual salary, you

must complete a MetLife Statement of Health Form and be approved by the insurance

company to add supplemental life coverage.

Dependent Coverage

You can elect coverage for your spouse

in $10,000 increments up to the lesser

of $250,000 or 50 percent of your own

supplemental coverage. If the amount of

coverage elected is more than $20,000,

your spouse must complete a MetLife

Statement of Health form. Your spouse

can be covered up to age 85.

You can elect coverage for your child (up

to age 26) in $5,000 increments up to a

maximum of $15,000.

You pay the full amount of the premium

for dependent coverage.

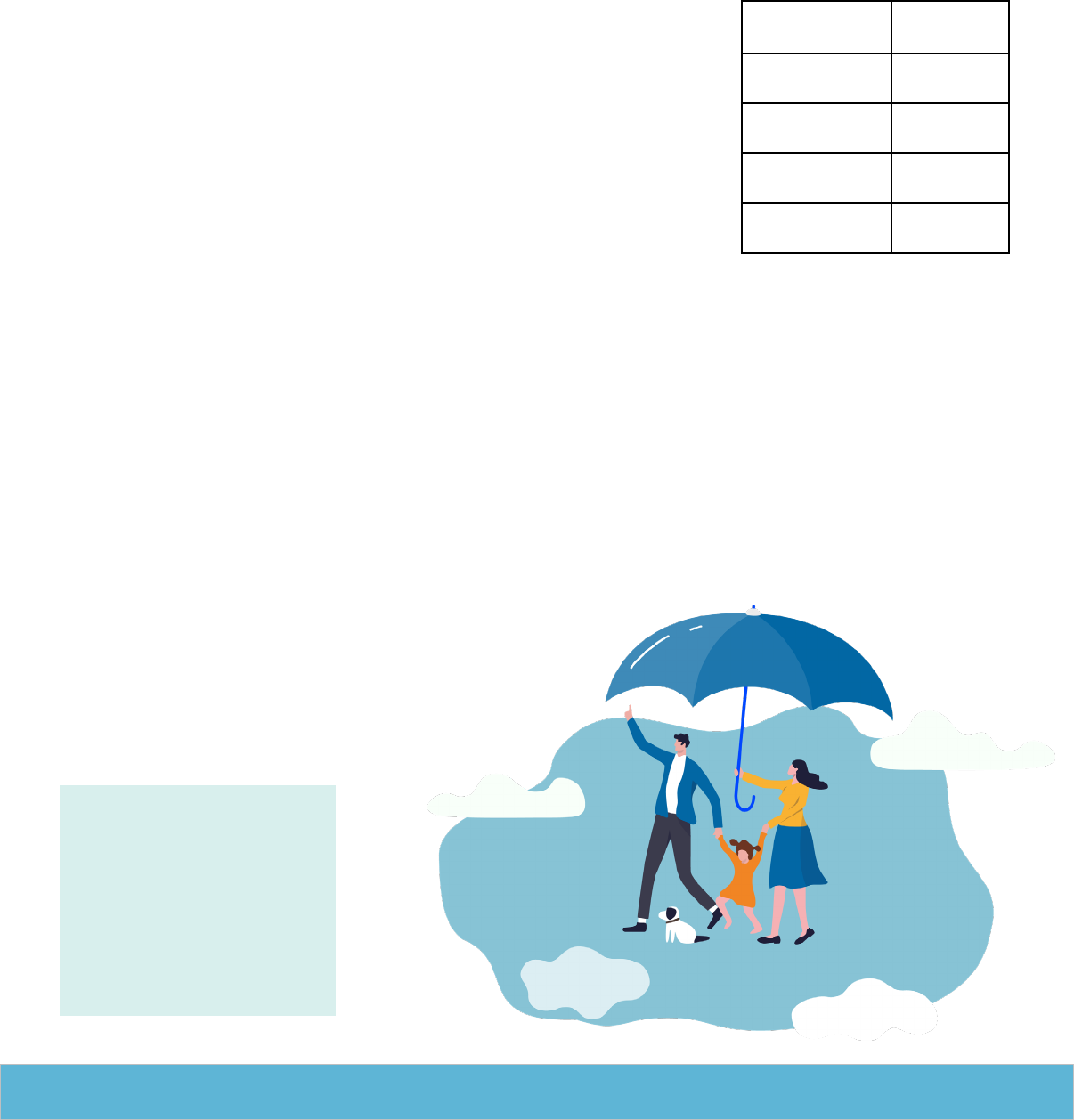

Eligible

Employee Age

% of Salary

65-69 67%

70-74 45%

75-79 30%

80+ 20%

Age Reduction Table

How to Enroll

You will be automatically

enrolled in basic life insurance

plan. You can enroll in

supplemental life insurance by

electing the level of coverage you

want in Workday within 30 days

of your hire date.

Will Preparation

If you enroll in supplemental life insurance, you can take advantage of MetLife’s

will preparation service, which also includes living will and power of attorney

preparation services.

More information can be found on the HR website at

https://hr.vumc. org/system/files/benefits/WillPrepPreEnrollment.pdf

All benefits-eligible employees have access to MetLife’s online will preparation

service, WillsCenter.com.

14

AD&D

(Accidental Death & Dismemberment)

Accidental Death & Dismemberment

(AD&D) is a plan that pays a benefit if you

lose your life, limbs, eyes, speech or hearing due to an accident.

AD&D is administered by MetLife.

You can enroll for individual or family coverage. Family coverage

includes your spouse and any dependent children up to the age

of 26.

You may purchase AD&D coverage in increments of $10,000 (up

to 10x your annual salary or $500,000, whichever is less).

To learn more about AD&D coverage and payouts, visit

hr.vumc.org/benefits/life#add.

MetLife Travel Assistance

If you purchase $10,000 or more of Accidental Death & Dismemberment insurance, you are eligible for

MetLife’s Travel Assistance. MetLife provides worldwide medical, travel, concierge, legal and financial

assistance services through Travel Assistance. For a full list of services, visit hr.vumc.org/benefits/ travel

and search “travel assistance.”

15

Short-Term Disability

Short-term disability insurance is available to fully benefits-eligible staff.* The benefit provides

nearly whole take-home income replacement if you are unable to work for an extended period

due to an approved medical condition.

Once you have fulfilled the two-week (14 calendar day) waiting period, short-term disability

insurance replaces up to 66 2/3 percent of your annual base benefits rate (up to $2,500 per

week maximum). Short-term disability benefits may continue for up to 24 weeks. The benefit is

administered by Unum.

Learn more in the Summary Plan Description at hr.vumc.org/benefits/sbc-eoc.

Enhanced Short-Term Disability

(coverage begins the first of the month following 30 days of service)

You will automatically be enrolled in the base and buy-up coverage on the first of the month following 30 days of employment

The base portion is paid for by VUMC and covers up to $24,000 of your annual salary. The buy-up portion is paid for by you and

covers your salary above $24,000.

You may waive the buy-up coverage at any time in Workday by electing “Waive” for the buy-up coverage of short-term

disability. Please note that if you waive the buy-up coverage and wish to re-enroll in the buy-up coverage at another time, you

will be subject to medical review and you could be denied.

* Eligibility applies to benets-eligible sta. It does not apply to faculty and post-doctoral fellows. Faculty and post-docs should refer to their manuals and

programs for guidance on disability and leave time. Those with house sta benets are eligible for short-term disability.

Enrollment

You are automatically enrolled in enhanced short-term disability the first of the month after 30 days of employment. Your

monthly cost is calculated automatically when you enroll. Employee-paid short-term disability premiums are after-tax, so you

do not owe income taxes on the benefit when you receive the disability pay.

Long-Term Disability

Long-term disability insurance replaces 60 percent of your

covered income if you become disabled and cannot work

for more than six months. Initially, a disability is one that

prevents you from working at your own occupation. Long-

term disability is administered by Unum.

This will cover the amount between $24,000 and your

annual base pay and includes a 10 percent monthly

contribution to your retirement account if you become

disabled and are a participant in the Vanderbilt University

Medical Center Retirement Plan.

How to Enroll

Automatic enrollment in the long-

term disability plan occurs on

the first of the month following

30 days.

You may waive the employee-

paid long-term disability coverage

at any time by logging into Workday and electing “Waive” for

Full Long-Term Disability.

16

Name Type Website Phone

Aetna Health plan

www.aetna.com

1.800.743.0910

BlueCross Dental PPO www.bcbst.com/members/vumc 1.800.565.9140

Cigna Dental Care Access DHMO

www.cigna.com

1.800.244.6224

Delta Dental Dental PPO www.deltadentaltn.com 1.800.223.3104

Fidelity Retirement

www.netbenefits.com/VUMC

1.800.343.0860

MetLife AD&D, Auto, Home, Life, Vision

www.metlife.com

1.800.638.6420

Navitus Health Solutions Prescription Drug Program

www.navitus.com

1.866.333.2757

WEX Health Flexible Spending Accounts www.myfsaexpress.com 1.877.837.5017

Unum Short-Term, Long-Term Disability

www.unum.com

1.800.836.6900

Nationwide Pet Insurance

www.petinsurance.com/vanderbiltumc

1.877.PETS.VPI

How to Enroll

To enroll:

1. Log in to Workday and select the

Inbox icon.

2. Select the New Hire Enrollment

task.

3. Answer the Health Questionnaire

for Tobacco Use.

4. Select Manage to choose your

benefits.

5. Choose Select or Waive for each

benefit.

Carrier/Provider Contact Information

Life Event Changes

Changes such as marriage or having a baby are examples of qualifying events. You

have 30 days after the date of a life event to make a change to your benefits. For more

information, see hr.vumc.org/record-updates.

You can make changes to retirement, enhanced short-term disability, long-term

disability and life insurance during the plan year, but you may need to meet other

requirements.

Open Enrollment

Each fall, you can make changes for the following year for these benefits: health, dental, vision, flexible spending

accounts, and AD&D.

Log into Workday to enroll in your benefits. You have 30 days from your hire date to complete your benefits enrollment.

Your elections for health, dental, vision, AD&D and FSAs stay in effect for the plan year (Jan. 1–Dec. 31), unless you have

a qualifying life event. If you make no election, you will be enrolled in the Aetna Plus health plan option for employee only

coverage and will miss out on enrolling in other benefits.

Retirement has a separate enrollment process. Refer to the 403(b) Retirement Plan section for more information.

17

Go for the Gold Program

Go for the Gold

Platinum Benefit

The platinum benefit is in

addition to the $240 Wellness

Credit. It provides partial reim-

bursement of membership fees

to Medical Center employees

who join the Vanderbilt Recre-

ation and Wellness Center.

This health promotion program helps faculty,

staff and their families lead healthier and more

productive lives by identifying health risks

and taking action to reduce those risks. If you

participate in Go for the Gold, and are enrolled in

the VUMC Health Plan, you can earn a wellness

credit of up to $240 per year.

Health Plan Account

If you are enrolled in the Aetna Plus or

Aetna Select, VUMC deposits your Go for the

Gold wellness credit into a Health Plan Account

managed by Aetna. The annual amount you earn

depends on your level of participation (bronze:

$120, silver: $180, gold: $240).

The Health Plan Account helps you pay your

deductibles and coinsurance. The credit can

be applied to other covered members on

your health plan, including your spouse and

dependents.

Aetna will automatically draw from this account

when they receive a bill from a doctor’s office or

facility. (The Health Plan Account does not apply

toward copays.) If the credit is not used, the

money will roll over each year. Contact Aetna to

find your balance.

If you are enrolled in the Health Savers

plan, VUMC deposits your Go for the Gold

wellness credit into your Health Savings Account

(HSA). The annual amount you earn depends on

your level of participation (bronze: $120, silver:

$180, gold: $240).

This amount is in addition to the $750 for

individual and $1,500 for family VUMC

contributes to your HSA. Note: Your Go for the

Gold wellness credit is included in the total HSA

contribution limits set by the IRS.

Wellness Credit Eligibility

The Go for the Gold Wellness Credit is available

only to employees who elect and pay for

the VUMC Health Plan, as health insurance

premiums fund the program.

If your spouse also works at VUMC,

waives Health Plan coverage, and is covered as

your spouse on the VUMC Health Plan, they are

not eligible to receive the Wellness Credit.

Learn more at:

hr.vumc.org/benefits/gftg-faqs

Participate in Go for the Gold by going to:

vumc.org/health-wellness/healthplus/

go-for-the-gold

18

Education Assistance

Staff

Staff may be reimbursed for 70 percent of tuition cost for one course of up to three credit hours (undergraduate or graduate-

level) per semester taken at any accredited college or university in the United States (not to exceed 70 percent of Vanderbilt

tuition for a similar course). Department manager approval is required. You must receive a grade of ‘C’ or better. Eligibility

starts with the semester beginning three months after your hire date. See the Education Assistance Programs policy on the

PolicyTech website for details.

College Coach

Benefits-eligible employees can access

a College Coach from a team of college

admissions and finance expert at our

tuition processing vendor, EdAssist. They

can help you plan for college costs and

maximize your child’s academic success.

You can talk one-on-one and get expert

advice on a range of topics, from how to

search for scholarships to how to write a

college admissions essay.

Nurse Student Loan

Repayment Program

Vanderbilt University Medical Center

(VUMC) offers a student loan

repayment program for direct care

nurses in eligible job codes. VUMC

will contribute $500 monthly towards

undergraduate student loans for those

in good standing. Eligible direct care

nurses can participate in this program

for four years with a maximum amount

up to $24,000. Nurses are eligible

to participate in the program after 3

months of full-time employment with

VUMC clinics and hospitals or VHCS.

Public Service Loan

Forgiveness

The PSLF program forgives the remaining

balance on direct loans after borrowers

have made 120 qualifying payments

under a qualifying repayment plan while

working full-time for a U.S. federal, state,

local or tribal government or a not-for-

profit (501(c)3) organization. Vanderbilt

University Medical Center is an eligible

employer, allowing employees to qualify

for PSLF. For more information, contact

the Workday Help Center.

How to Access your Benefits

For more information about how to enroll/apply and to access the EdAssist portal at

hr.vumc.org/benefits/tuition.

19

Year Non-exempt employees Exempt employees

1

(date of hire to 1st anniversary)

200 hours 30 days

Standard

hours

Allotment

30 or more 100 percent

20 to 29 75 percent

10 to 19 50 percent

Less than 10 25 percent

New/Transfer Employees: exPTO Allotment

If your start date is after July 1, visit the HR website for a prorated exPTO allotment

chart.

hr.vumc.org/secure/flexpto-medicalcenter

flexPTO

Current Employees: exPTO Allotment

If you are a current, full-time employee, you will receive the following allotment of time.

Note that the time is based on years of service on July 1 of the current scal year.

VUMC also offers options for

leave, including:

• FMLA

• Non-FMLA

• Parental leave

• Bereavement

• Jury duty

• Military leave

See vanderbilt.policytech.

com for details.

flexPTO Donate

Employees can donate up to 40 hours of flexPTO to a colleague who is

experiencing a hardship due to a qualifying serious personal or family medical

situation through the flexPTO Share program.

Visit hr.vumc.org/secure/flexpto-medicalcenter for details.

Prorating exPTO

allotment based on

standard hours

If you work less than 40 hours

per week, your time will be

pro-rated as follows:

VUMC’s flexPTO program provides eligible

staff* with a flexible bank of time off that

can be used for vacations, holidays and

brief illnesses.

Flexible paid time off programs are valued

in many organizations because they meet

the needs of today’s diverse workforce,

offering staff choice and flexibility at every

life phase. The VUMC flexPTO program

is a use-it-or-lose it program, meaning

unused hours do not roll over to the next

fiscal year and are not paid out if you

leave VUMC.

The amount of time off is based on your

years of service and Fair Labor Standards

Act job status (exempt or non-exempt).

VUMC staff receive an allotment of time

at the beginning of each fiscal year to use

over the next 12 months. Each fiscal year

runs from July 1 to the following June 30.

Staff in their first year of service should

refer to the charts below for flexPTO

allotments.

See the flexPTO program guide for the

Medical Center for complete program

details and to see how much time

you will receive in future years. Learn

more at hr.vumc. org/secure/flexpto-

medicalcenter.

VUMC also provides a two-week paid

parental leave for eligible birth parents,

spouses to birth parents, and adoptive

parents. This paid leave can also be used

during the waiting period for short-term

disability, if you elect to enroll in this

coverage.

* Employees in positions covered by the collective

bargaining agreement shall refer to the exPTO

chart in the agreement for accrual time.

Fully benets-eligible sta

can receive two weeks of

paid parental leave following

the birth or adoption of a

child. This paid leave can be

used during the two-week (14

calendar day) waiting period

for short-term disability.

20

Glossary of Terms

Bundles

VUMC employees and their dependents in the

VUMC health plans are eligible to participate in the

MyHealthBundles program, which bundles all the

services you need to manage both common and

complex health conditions, with little to no out-of-

pocket costs.

Copay

A copay is what you will pay for an office visit. Aetna

Plus and Aetna Select members pay a $25 copay for

office visits and a $5 copay for telehealth visits with

VUMC providers.

Deductible

A deductible is the amount you pay before the health plan

starts to cover more of the costs.

E.O.B.

The Explanation of Benefits details how much of a

doctor or hospital visit was covered by your VUMC

health care insurance and how much you are required

to pay.

F.S.A

A flexible spending account allows you to increase

your take-home pay by decreasing your taxable

income using tax-free dollars to pay for eligible out-

of-pocket medical, dental and vision expenses and/or

dependent day care expenses.

Health Plan

A health plan provides comprehensive health care services

to its members. VUMC offers three health plan options:

Aetna Plus, Aetna Select and Health Savers. The Health

Savers plan is a high-deductible plan and includes a Health

Savings Account (HSA).

Network

A network is a group of physicians, hospitals, and other

health care providers that have agreed to provide medical

services at pre-negotiated rates. VUMC’s health plan

options have three networks: VUMC/VHAN Affiliates,

which offers maximum savings; Aetna Preferred Providers,

which offers modest savings; and Out-of-Network, which

has the highest deductibles and out-of-pocket maximums.

Out-of-Pocket Maximum

The out-of-pocket maximum is the most you will have to pay

for covered health care services within a benefits plan year.

Premium

A premium is what you pay each month to be in the health

plan. Premiums are deducted from your paycheck. At

VUMC, health care premiums are based on salary bands and

increase as your salary increases.

P. P.O

A PPO is a medical plan with coverage provided to

participants through a network of selected health care

providers, such as hospitals and physicians.

To make the best health care choices, it can be helpful to know the lingo. Below are some common benefits terms

and their definitions.